(Bloomberg) -- At least three major creditors to China Evergrande Group have given it more time to repay maturing loans, according to people familiar with the matter, offering some relief for the cash-strapped developer as it fends off a string of demands for unpaid dues.

China Minsheng Banking Corp., China Zheshang Bank Co. and Shanghai Pudong Development Bank Co. have agreed to give the developer extensions on some project loans, according to the people familiar, who asked not to be identified as the discussions are private. Zheshang Bank pushed till year-end the repayment of two loans due in July and August, one of the people said.

While it’s unclear if other lenders are making similar accommodations, the extensions will give the troubled property giant room to accelerate efforts to sell assets and stave off a liquidity crisis. Reports in recent weeks about wary banks and ratings agencies as well as unpaid suppliers have stoked fears of a potential default, causing Evergrande’s stock and bonds to crater.

China’s Supreme Court last week ordered all cases against the embattled developer and its affiliates to be centralized with a court in Guangzhou, according to a person familiar with the decision.

The move would prevent local courts from freezing Evergrande’s assets, including deposits, at the request of a single claimant, essentially giving it time to raise cash and ensure an orderly resolution to its problems. Evergrande made the request on centralizing cases itself, one person said.

Evergrande, China Minsheng, Zheshang Bank and Pudong Bank didn’t immediately respond to requests for comment.

A three-day rally in Evergrande shares fizzled Thursday on a report that a construction firm halted a project in southern China over a missed payment. While the report was later removed, unpaid suppliers have been publicizing their disputes with the company this year and one lender temporarily froze the a deposit over a loan dispute.

Shares tumbled 8.9% in Hong Kong as of 2:58 p.m., taking this year’s slide to 61%. The 8.75% 2025 dollar bond fell 4.2 cents on the dollar to 41.4 cents after climbing a combined 5.1 cents the prior two days, according to Bloomberg-compiled prices.

Banks have been cautious in offering new credit or renewing maturing loans to Evergrande, though their existing exposure to the developer makes it hard to pare lending sharply without incurring impairments on their balance sheets.

China Minsheng, one of the largest creditors to Evergrande, said in June it had cut its exposure in the previous nine months even though Evergrande and its affiliates haven’t defaulted on any interest or principal payments. The company said the reduction came as it was able to raise more cash from property sales.

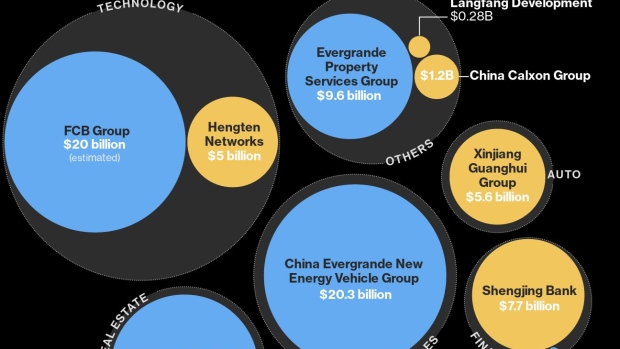

Evergrande’s complex web of liabilities -- including bank loans, bonds and down payments from homebuyers -- swelled to 1.95 trillion yuan ($301 billion) at the end of last year, about 77% of which were due within 12 months, according to its annual report. Bank loans and other borrowings from firms including trusts accounted for about 81% of the developer’s 335.5 billion yuan of interest-bearing debt coming due in 2021.

With about $19 billion of offshore bonds, Evergrande stands alongside China Huarong Asset Management Co. as one of the most prolific Chinese issuers of dollar debt. Like Huarong, it’s considered a litmus test of the government’s willingness support embattled borrowers as policy makers try to balance sometimes competing goals of maintaining financial stability and reducing moral hazard.

©2021 Bloomberg L.P.