Blackstone Strikes $1.6 Billion Student Housing Deal With KKR

Blackstone Inc. agreed to sell a student-housing portfolio to KKR & Co. for $1.64 billion.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Blackstone Inc. agreed to sell a student-housing portfolio to KKR & Co. for $1.64 billion.

Adler Group SA has reached an agreement in principle with some bondholders on another overhaul of its debtload, as the embattled German real estate firm struggles to sell properties and raise liquidity.

Czech real estate billionaire Radovan Vitek is doubling his asset-sale target, in a bid to curb debt after a buying spree that made him one of Europe’s largest landlords.

It’s independents, a growing voting bloc, who drive election victories in the swing state, where the GOP is rushing to defuse abortion as an issue.

The deep freeze that’s gripped Europe’s real estate markets since borrowing costs jumped worsened at the start of the year as deals plunged to their lowest levels since 2011.

Dec 8, 2021

, Bloomberg News

(Bloomberg) -- When China Evergrande Group finally acknowledged the need for a debt restructuring last week, the embattled property giant pledged to “actively engage” with offshore creditors to create an overhaul plan.

But the reality is that both Evergrande and its bondholders are likely to have little control over what happens next.

That power lies with China’s Communist Party, including authorities from Evergrande’s home province of Guangdong. Officials from the province dominate a risk-management committee unveiled by the developer this week to guide its overhaul.

For international creditors, the government’s hands-on role is a mixed blessing. While it may help prevent nightmare scenarios of an uncontrolled Evergrande collapse, Chinese policy makers will almost certainly put offshore bondholders near the bottom of a priority list that includes homeowners, employees, individual investors, suppliers and Chinese banks.

Here are some of the questions international investors are considering as they weigh the value of Evergrande bonds (most of which are trading below 20 cents on the dollar):

What role will China’s government play?

Regulators have made it clear they have no appetite for an Evergrande rescue. At the same time, they’re now deeply involved in management of the company. Guangdong said last week it would dispatch a team to Evergrande to ensure “normal” operations. The developer’s new seven-member risk committee includes senior managers from Guangdong state-owned enterprises and China Cinda Asset Management Co., the nation’s largest bad-debt manager. Another is from a law firm, while only two members are from Evergrande, including Chairman Hui Ka Yan, the company’s controlling shareholder.

“The Guangdong provincial government is likely taking a lead role in dealing with Evergrande’s debt problem and finding ways to make sure the company’s finances hold up as long as possible,” said David Qu, an economist at Bloomberg Economics.

Guangdong’s government may provide some capital to support Evergrande projects but will probably “stop short of bailing out the entire company including all of its bondholders,” said Andrew Collier, managing director of Orient Capital Research Inc. in Hong Kong. For the committee, the hard part is to figure out which assets to target, he said. “That’s a very difficult political calculus.”

Are there any precedents?

Qu said authorities may follow the principle that guided the seizure of Baoshang Bank Co. in 2019: prioritizing social stability, with a “bail-in” of institutional investors to be used when needed. In Evergrande’s case, homebuyers are probably equivalent to depositors at Baoshang, who were fully repaid, he wrote in a note.

He Jun, a researcher at independent strategic think tank Anbound Consulting, sees a potential road map in the restructuring of HNA Group Co. HNA’s home province of Hainan formed a government-led working group in February 2020, effectively taking control of the conglomerate. About a year later, it entered a court-led restructuring.

Hainan Development Holdings Co., owned by the provincial government, was later introduced as a strategic investor for HNA’s airport business, while privately owned Liaoning Fangda Group Industrial Co. took control of its airline operation. HNA founder Chen Feng was detained in September along with Chief Executive Officer Tan Xiangdong for unspecified crimes.

How bad are Evergrande’s finances?

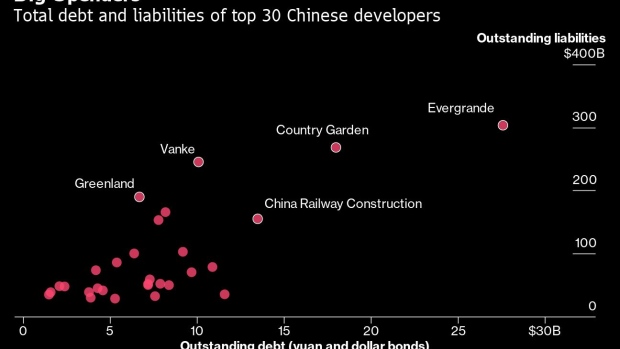

Evergrande reported 1.97 trillion yuan ($310 billion) in liabilities as of June 30, the most among its peers in China. Almost half of that amount is bills to suppliers and other payables, while interest-bearing debt totaled 572 billion yuan, down 20% from six months earlier. The company has reduced its net debt-to-equity ratio to below 100%, meeting one of the Chinese government’s “three red lines” -- metrics imposed to limit borrowing by real estate companies.

The company has $19.2 billion in offshore dollar bonds outstanding, the most among Chinese developers. Another risk for creditors is the firm’s guarantees on related-party debts, including private placement bonds with limited disclosure. Evergrande reported 557 billion yuan of financial guarantees to home buyers and business partners as of June.

How much bargaining power do offshore bondholders have?

Not much. Some offshore bondholders see little use in pressing their case in Chinese courts, given the government’s heavy involvement in the overhaul. The fact that this is a cross-border restructuring with debt-issuing units listed in multiple jurisdictions creates another challenge for bondholders trying to get organized and show a united front.

Still, some offshore creditors are already consulting with financial and legal advisers. It could help that bondholders may include some of the world’s biggest investment firms, which China is unlikely to want to alienate. Ashmore Group, BlackRock Inc., FIL Ltd., UBS Group AG and Allianz SE have all reported holding Evergrande debt in recent months, Bloomberg-compiled data show.

Some of Evergrande’s bondholders own notes across multiple maturities and units. That means they’re less likely to get tied up in their own legal tussles over which notes should receive preferential treatment and can focus on working as a group in talks with the developer.

How will they be treated relative to onshore creditors?

Evergrande bondholders including Marathon Asset Management have said they expect offshore creditors to be near the bottom of the queue for repayment. The Chinese government’s prime motivation is often maintaining social stability, which in this case means giving priority to homeowners, employees and individual investors in wealth management products.

Evergrande’s overseas obligations also include bonds with keepwell provisions. These are essentially a gentleman’s agreement that often involves a pledge to keep an offshore issuer solvent, which may not be legally recognized in this restructuring.

©2021 Bloomberg L.P.