New US Home Sales Jump to Highest Level Since September

Sales of new homes in the US bounced back broadly in March as an abundance of inventory helped drive prices lower.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Sales of new homes in the US bounced back broadly in March as an abundance of inventory helped drive prices lower.

Hong Kong developer Lai Sun Development Co. is considering options for a planned office tower in the City of London, including a potential sale of a stake in the project.

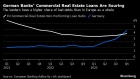

Germany’s financial regulator BaFin is taking a closer look at the real estate used by lenders to secure covered bonds known as Pfandbriefe, a €400 billion market traditionally considered among the safest in credit.

Taylor Wimpey Plc is failing to see lower mortgage rates translate into higher levels of home sales and is maintaining its forecast for fewer deals in 2024.

Chinese mainland investors increased their portion of total turnover of Hong Kong stocks to a record daily average in April, with the latest measures to bolster the city’s position potentially boosting their purchases.

Oct 19, 2021

, Bloomberg News

(Bloomberg) -- Risks to the economy from the meltdown of China Evergrande Group are “contained” for now, according to a senior official with the International Monetary Fund.

“People understand that the government has the tools to contain the risks going forward,” Helge Berger, head of the fund’s China mission, said on Bloomberg Television. Risks in the property sector are contained to the sector at the moment, but authorities should keep monitoring in case they escalate, he said.

China’s property sector is highly leveraged, and the authorities’ efforts to deleverage are welcome, Berger said, but they need to be careful not to go too fast or too slow.

Developer China Evergrande Group’s debt crisis has intensified a downturn in the country’s real-estate sector and weighed on the economic outlook. China’s property and construction industries contracted in the third quarter for the first time since the start of the pandemic.

The IMF cut its growth forecast for China and the Asia-Pacific region this year on a surge of the delta variant and lagging vaccinations. China’s forecast was trimmed to 8% from 8.4% to reflect ongoing outbreaks of the virus, fiscal policy tightening and stresses in the property sector.

©2021 Bloomberg L.P.