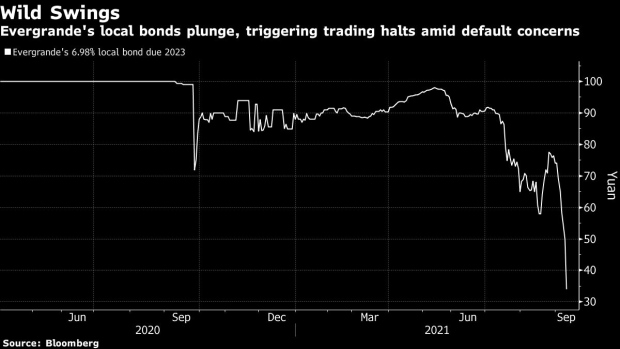

(Bloomberg) -- China Evergrande Group’s wild local bond swings show just how risky it can be to trade stressed assets in the nation’s domestic market.

A plunge in the price of the developer’s yuan bond due 2023 triggered trading halts on Thursday before it closed down 32% at a record low of 34 yuan. Two other Evergrande local notes saw pauses during the session, coming as the firm’s onshore bonds have slumped the past week and prices catch up with the declines in its dollar debt.

China’s nascent onshore credit market has a growing pool of stressed bonds, but not many investors who want to buy them. That can leave bondholders exposed when it comes to riskier types of investments as the lack of liquidity makes it hard to offload holdings at pace. The dramatic and patchy pricing on Evergrande’s local bonds -- the 2023 note has slumped from 74 yuan in just over a week -- means buyers may have to accept steep losses when they do sell.

Investors at fixed income funds looking to sell their positions in Evergrande’s local bonds the past two weeks are struggling to find buyers, according to onshore traders who aren’t authorized to disclose details about their strategies. One broker said he hasn’t traded any of the bonds this week after seeing no bids.

Many institutional investors, who make the bulk of China’s fixed income participants, don’t have the mandate or appetite to buy the equivalent of high-yield bonds, those rated AA or below by domestic Chinese credit assessors. Such debt is typically bought by private funds whose clients must be “qualified” buyers with a sufficient appetite for risk.

Policy makers have taken steps to improve liquidity and attract more capital into China’s credit market in recent years by shaking up its local credit rating firms and introducing better pricing of risk by selectively allowing more defaults. Still, progress has been limited.

The type of pricing action seen among Evergrande’s local bonds could impact a broader pool of investors if fears about a debt crisis at the company prompts a selloff in other weaker-rated developers. Rising concern about Guangzhou R&F Properties Co. spilled into the domestic market this week after its yuan bond due 2022 was halted after falling more than 20% on Monday to a fresh low.

©2021 Bloomberg L.P.