Feb 25, 2021

EVs Are More Expensive Than Traditional Cars—But Not by Much

, Bloomberg News

(Bloomberg) --

Last week, I engaged in a thought experiment about the future of the American gas station once electric vehicles take over the road. My conclusion: the big highway rest stop is probably OK, as is the urban fuel oasis; it’s the suburban gas station that may be turning into something else.

That experiment didn’t address how those EVs will actually get on the road, however — that is, who’ll buy them and why?

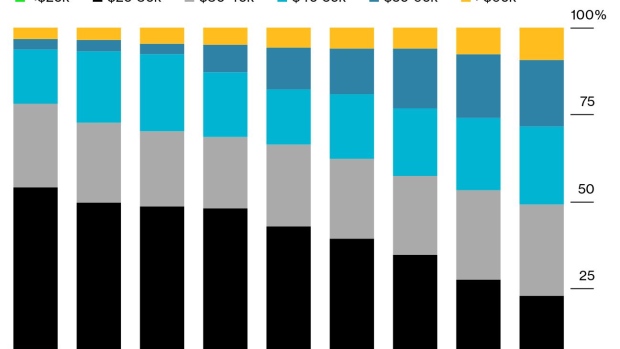

One way to think about this is to look at auto sales not by powertrain (i.e. what makes it go), or by body design, but by price. When we do that, we see something striking: inexpensive new cars have pretty much vanished in the U.S. In 2012, more than 50% of new vehicles sold were priced below $30,000. Last year, more than 50% of vehicles priced above $40,000.

Now, there is some inflation at work in this price trend, but not that much. Using some basic U.S. Bureau of Labor Statistics math, a $20,000 car in 2012 would cost $22,760 today. That’s an increase of 14% over nine years.

If inflation doesn’t explain this price trend, the logical conclusion is that new car sales are going upscale. That holds for new car leases, too. I picked seven luxury brands and plotted their lease penetration (i.e. the percentage of vehicles that are leased by a company’s finance unit rather than sold outright), as well as each brand’s true market value (i.e. the average price buyers or lessees pay across the brand). I also included four mass-market brands for comparison.

What we see is that all seven luxury brands lease at least 40% of their vehicles, and three lease more than half. They also have true market values between $41,900 and $60,000. Bigger-volume brands, on the other hand, have lower lease penetrations and generally lower true market values (Ford is an exception: very low lease penetration, but also a higher true market value than Audi).

These three market characteristics — the disappearance of the inexpensive new car, the high penetration of leasing for luxury brands, and the high true market value for luxury vehicles — gives me reason to think that EV sales could move quickly.

People still say that EVs are “expensive,” and yes, they do have a higher upfront cost than a comparable conventional car today. But given that half the new car market is priced above $40,000 and more than a quarter is priced above $50,000, the absolute cost is not excluding vehicles from the market.

Last year, an analysis from BloombergNEF found that “upfront cost parity” for U.S. electric and internal combustion vehicles will arrive in 2024. That’s a milestone: in three years, there will be no price difference and no EV sticker shock. EV models might still be relatively expensive, but they won’t be more expensive than a comparable internal combustion engine vehicle.

That timeframe is important for another reason: three years equals one leasing cycle. Anyone leasing a luxury vehicle today will be returning that car to the dealer in 2024 and likely finding that there’s an electric vehicle waiting for them at their accustomed price point. That decision about the next lease won’t require any total cost of ownership math or a sales pitch that says “well, sure you pay a bit more upfront, but your bills are lower!” It just requires a “what do I want?” car-buyer’s decision, an emotional buyer’s connection, and that will be a milestone too.

Nathaniel Bullard is a BloombergNEF analyst who writes the Sparklines newsletter about the global transition to renewable energy.

©2021 Bloomberg L.P.