Aug 4, 2021

Ex-Enron Trader Discovers Greed Is Good—for the Environment

, Bloomberg News

(Bloomberg Markets) -- Anytime Ulf Ek needs to think, he goes for a walk in London’s Richmond Park with Dollar, a Maltese-Yorkie mix. The 2,500-acre expanse of fields, forest, and deer herds about 12 miles southwest of the financial district has long been a bucolic respite from urban life.

In the 17th century, King Charles I moved his court to a nearby palace to avoid the plague. For Ek it’s a break from the frenzy of the energy markets; he knows just how fraught that world can be, having lived through a price meltdown that cost him a fortune and made him nauseous.

As Dollar sniffed around the park one day in late 2017, Ek, the founder and chief investment officer of hedge fund Northlander Commodity Advisors LLP, mulled over some news he’d later use to make tens of millions of dollars.

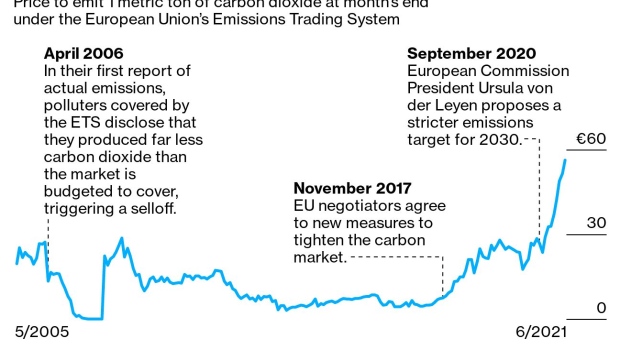

In Brussels, European Union policymakers were finalizing plans to overhaul the bloc’s Emissions Trading System, a carbon market created to reduce greenhouse gas emissions by making them a tradeable commodity like soybeans or gold. The ETS—the biggest market of its kind—wasn’t working. Generous pollution limits in the system’s design had flooded the market with carbon permits. Prices were too low to persuade businesses to clean up, so the EU drafted measures to boost prices by removing permits from the market.

Ek was trying to figure out how the market would react to the EU’s latest moves and how he should play it. A Swede who’d moved to London in 1998, Ek had bought and sold European electricity and gas contracts for about two decades, including at Enron Corp. and Deutsche Bank AG. He’d followed the ETS since its inception in 2005 but cooled on the market after a disastrously bad bet lost him about €12 million ($14.2 million) just months later.

Now he was intrigued once again. The effect of the EU decision on permits seemed obvious: If supply was set to go down and demand stayed the same, prices could only go up.

Or maybe it wasn’t that simple. During his regular walks with Dollar, by Bishop’s Pond or past King Henry’s Mound, Ek puzzled over something that initially had made him hesitate to bet on carbon’s rise: As the EU discussions progressed, the market had barely moved, and that didn’t make sense.

Ultimately, Ek concluded that everyone else was calculating that the price wouldn’t increase until the new policies were actually implemented in more than a year. “I realized that’s irrational,” says Ek, who’s now 50. “Once I figured that out, I decided, ‘Let’s put this trade on.’”

He was happy he didn’t wait. By the end of 2018 the EU carbon price rose more than 200%. “I was right,” Ek says. “And I was making a lot of money because I was right.”

Ek was among a handful of investors, including Per Lekander at Lansdowne Partners (UK) LLP and Robert Gibbins at Autonomy Capital, who moved into the EU carbon market early and were rewarded handsomely.

The price moves that made them rich also helped shift the financial calculus of power production. Utilities started burning less coal—the dirtiest way to generate electricity—and more gas, which isn’t as emissions-intensive. Last year, according to BloombergNEF, coal plants with 15.5 gigawatts of capacity shut down—a record. Without the surge in carbon costs under the ETS, many of those coal plants would still be profitable.

On the other hand, while climate activists applaud rising prices, the increases are a worrying sign for the industries required by the EU to buy the permits. If carbon gets too expensive too fast, many of those companies may not be able to afford investments in greener technologies. There’s already evidence this year that the surge in trading by speculative traders like Ek has contributed to the market’s volatility.

“More volatility is poison to industrial investment in abatement technologies,” says Marcus Ferdinand, due to become a senior consultant for European power and carbon with Oslo-based Thema Consulting Group on Aug. 16. “They need foresight and planning horizons to anticipate what the carbon price will be in 5 to 10 years.”

Ek doesn’t buy that. He views his contribution to the rapid carbon price rise as a part of a Darwinian natural selection process. “The firms that are prepared, they will do all right, and the ones that aren’t will fail,” he says. “The quicker the price goes up, the sooner they’ll invest.”

Now the EU is toughening its climate policies again to reach its new goal of climate neutrality by 2050. As a result, lawmakers in Brussels are sharpening the tools that first caught Ek’s eye.

In July the European Commission unveiled a proposal for more ambitious pollution cuts for the market that would make permits more scarce. Under the “cap and trade” principle, the EU sets an upper limit on the total amount of greenhouse gases that can be emitted by power stations, factories, and the like. EU allowances, or carbon permits, are then auctioned off or allocated for free and can subsequently be traded. The EU also wants to impose a carbon levy on imported steel, cement, and aluminum. Together, these changes aim to convince more industries, in the EU and abroad, that it’s cheaper not to pollute.

And just as in 2018, the market has started to move ahead of the policies, driven in part by speculators like Ek. Carbon futures are up about 60% since the beginning of the year to a record high of more than €50 per metric ton. Forecasters at Barclays Plc and BNEF have raised their targets. By the end of the decade, carbon could surpass €100 per metric ton, some analysts predict, high enough to help turn a swath of technologies that are currently prohibitively expensive into major parts of the EU economy, slashing greenhouse gases along the way.

This state of affairs has created an unlikely alliance of financial speculators and environmental activists. Both say the planet needs carbon prices to be much higher to help fight rising temperatures. But only one side of the alliance will get paid when that happens. “If you buy carbon emissions, you drive prices up,” Ek says. “Greed can be a wonderful thing when it works for the benefit of the environment.”

Ek grew up in Toreboda, Sweden, a town about 200 miles west of Stockholm. His mother was a teacher; his father owned a small construction business. He left home at 19 to fulfill his military service and then to study at the Stockholm School of Economics, where faculty regularly sit on the committee that awards the Nobel Prize in economics. After earning his diploma in the late 1990s, he landed a job in London at Enron, then the biggest power-trading company.

There, Ek learned to analyze how government action could affect the continent’s heavily regulated energy markets. It also was the first time he saw a company consider the value of climate change in its trades. Houston-based Enron grew rapidly and handed out responsibility easily, and Ek soon was leading client meetings and building complex trades to buy and sell power across Europe.

Ek left for a job at Dynegy Inc., an energy company, in early 2001, just a few months before Enron declared bankruptcy amid a massive accounting scandal. (In 2002, Dynegy, a one-time suitor of Enron, itself fell into financial distress, settled fraud charges, and exited speculative energy trading.) Over the following decade, he worked at various banks and hedge funds in London. In 2004, during a stint as a trader at Deutsche Bank, Ek read about the coming launch of the EU’s carbon market. He, like most in the field, expected the price to go up and decided to invest.

This is exactly what the architects of the ETS were hoping for, says Peter Vis, who helped design the system while working on climate policies for the European Commission and is now a senior adviser at consulting firm Rud Pedersen Public Affairs in Brussels. The system purposefully allowed for trading not just by the companies obligated to account for their emissions, but also by financial players or nongovernmental organizations that could buy allowances as an act of advocacy.

“A rising carbon price is exactly what was intended to address the ‘climate crisis,’ ” Vis wrote in an email. “The involvement of financial intermediaries in the market has greatly added to liquidity, which enhances the cost-effectiveness of emissions trading as an instrument of climate policy.”

When the market launched, Ek bought contracts for electricity that would let him gain if the emissions price rose. He estimated power plant operators would have to raise prices by about €5 per megawatt-hour to account for the cost of carbon.

QuickTake: How Carbon Markets and Taxes Work (or Sometimes Don’t)

Later in 2005, Ek moved to the London office of the U.S. hedge fund Amaranth Advisors LLC and brought the carbon trade with him. He was up about €30 million for the year when disaster struck. His position was based on the idea that there was a scarcity of permits. But in the spring of 2006, polluters covered by the market reported their actual emissions for the first time, and it turned out they produced far less carbon dioxide than the market was budgeted to cover.

On the morning of April 26, the carbon price plummeted, and over the course of the day Ek worked furiously to liquidate his entire position. By the end of the day, he’d lost about €12 million and slashed his profit for the year by a third. At one point he dragged a trash can over to his desk in case he got sick. He told his analyst, who’d turned pale after being screamed at by Ek all morning, to go home.

“As a trader, you remember those days,” Ek says. “The tough part was maybe only four hours. But I used more energy in those four hours than in a month of normal trading.”

When it was over, Ek called up his boss, Brian Hunter. “I’m still up for the year, so don’t fire me,” he recalls telling Hunter. “He didn’t care. He said, ‘If you want to double up the position, I’m behind you.’ ”

(As it happens, Hunter was at the time in the middle of losing billions of dollars on a natural gas trade that would ultimately bring down Amaranth. His trading landed him in the crosshairs of the U.S. Commodity Futures Trading Commission, which claimed he’d attempted to manipulate the price of gas futures contracts. Hunter later agreed to pay $750,000 to settle the dispute.)

Ek went on trading carbon for another seven years or so. After that, he says, he lost interest and didn’t think about the carbon market much. He traded energy commodities at Brevan Howard Asset Management LLP and Barclays before starting Northlander in 2012. Meanwhile, the EU carbon price stagnated for close to a decade at less than €10 per metric ton. It wasn’t until 2017 and the news about EU intervention that Ek saw carbon as being worthwhile again.

Pierre Andurand, who made his name and wealth as an oil trader, has known Ek for the best part of a decade. Andurand, founder of London-based hedge fund Andurand Capital Management LLP, says it makes sense that Ek’s expertise in trading power and natural gas would point him to the carbon market. “It’s kind of natural for him to look at carbon,” Andurand says. “I was a bit skeptical at the time because it was a market that had been designed so poorly.”

Now Andurand is treading the same path as Ek. He started trading carbon last year and credits it for his fund’s positive returns in 2021. Big trading houses such as Vitol Group and Trafigura Group Pte Ltd., with legacies of buying and selling fossil fuels, are hiring carbon traders. It’s all part of a broader shift as the biggest energy companies recalibrate for a world that’s increasingly run on electricity instead of oil.

Ek says it’s time for him to double down on the carbon bet. He started a new fund this year—the Northlander Environmental Fund—that will focus exclusively on the rise of carbon prices not just in the EU, but also in smaller carbon markets in the U.S. and perhaps in new ones popping up in the U.K. and Asia.

“We can actually make money in an opportunity that will help the environment,” Ek says, looking out at the Thames from a riverside terrace near his Richmond office and home. “I can contribute a lot more to a reduction of climate change than I could ever do by giving money to charities.” —With Ewa Krukowska

Mathis covers renewable energy and climate change in London.

©2021 Bloomberg L.P.