Jan 25, 2022

Ex-Goldman Marcus Head Launches Crypto and Stocks Investing App

, Bloomberg News

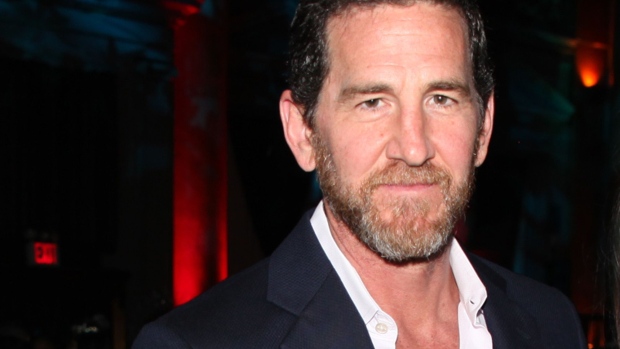

(Bloomberg) -- Adam Dell, the former head of product at Marcus by Goldman Sachs Group Inc., launched stocks and crypto investment platform Domain Money on Tuesday, bringing with him a team of 25 employees from the bank to the new venture.

Domain Money, which targets retail users, raised $33 million from investors including Bessemer Ventures and Marc Benioff, the co-founder of Salesforce.com Inc. It differentiates from similar products by offering actively managed investment strategies, curated by an investment team that counts ex-employees from Goldman and Bridgewater Associates among its members. Users pay 1% annual management fee for these active strategies.

The launch came amid a broad-market tumble, which saw Bitcoin plunging nearly by half from its all-time high in November. Still, the platform has “thousands of customers” signed up since the morning, Dell said. “Short-term market swings of being in a bearish market may dissuade some investors from participating, but the more thoughtful investors will appreciate the opportunity” in the long term, he said in an interview.

Crypto trading is provided to customers by Gemini Trust Co., and securities trading and custody is provided by Apex Clearing Corp., according to Domain Money’s website.

Advisers to the company include Elisha Wiesel, former CTO of Goldman Sachs, and J. Christopher Giancarlo, former chairman of the Commodities Futures Trading Commission. Domain Money also hired staff from crypto companies including Coinbase Global Inc. and BlockFi, Dell said.

Dell, the brother of billionaire Michael Dell, earlier founded personal-finance startup Clarity Money, which was bought by Goldman in 2018 and folded into its retail-facing Marcus product. As part of the deal, Dell joined Goldman as a partner.

Asked if being acquired or going public is part of the long term plan for Domain Money, Dell said he’s “focused on building a standalone company” with ambition to provide full financial services that “speaks to the needs of sophisticated retail investors.”

©2022 Bloomberg L.P.