Mar 20, 2023

Expectations for U.S. rate moves most uncertain in decades: Larry Berman

By Larry Berman

Larry Berman's Educational Segment

The history of forward guidance for the U.S. Federal Open Market Committee (FOMC) started in February 1994 under Greenspan.

The March 22 meeting currently has the probably of a 25 bps rate hike at 60 per cent with less than certainty that we see any more rate hikes this year. By December, the odds of 100 basis points of rate cuts is already priced in. We think that is way off the likely outcome unless equities make lower lows.

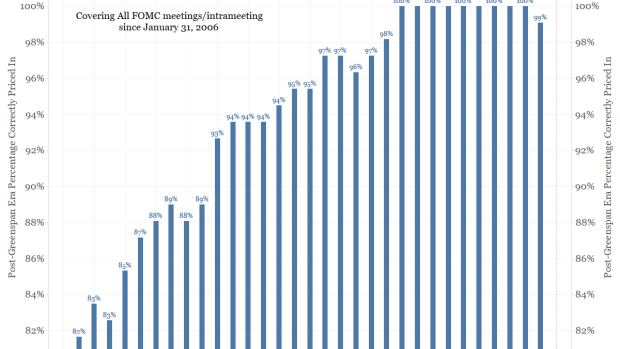

Data compiled by Bianco Research and published on Twitter shows that from 10 days to two days before the FOMC meeting (the blackout window), whatever the market priced in happened 100 per cent of the time.

According to Bianco, “the market was only 99 per cent accurate on the day before a meeting. That was September 16, 2008, one day before a meeting, the market switched from no move to pricing in a cut due to panic surrounding Lehman’s bankruptcy, which was September 15, 2008. The probability of a cut on September 16, 2008, shot up to 68 per cent from well below 50 per cent, or pricing no move, in the days leading up to that FOMC meeting. The Fed did not cut at that meeting. They held steady. HOWEVER, the Fed did cut rates by 50 basis points in an emergency meeting on October 7.”

This certainly is similar to the current market environment, so it should not be too surprising to see this level of policy uncertainty. This suggests the FOMC does a good job communicating their intentions. The world is very different today than it was when U.S. Federal Reserve Chair Jerome Powell was testifying to Congress 11 days ago hinting that more aggressive rate hikes were needed. The Fed had “no clue” what was developing in the regional banks they regulate, which should be very disturbing.

The market makes some assumptions about the FOMC’s reaction function. Bianco contends that “the Fed is intensely political. They will protect their institution first. They do not want to be blamed for causing a banking crisis.” We saw U.S. Senator Elizabeth Warren recently blame Powell for igniting the issue due to a weakening of regulations. What we do know is that historically, when markets get extreme, and only when they are extreme, the Fed "buckles" to the market.

They last “buckled” on the rate hike side in December 2018/January 2019, but they were not fighting the same sort of inflation they are today. At the December 19, 2018, FOMC meeting, Powell described their quantitative tightening as being on "auto pilot." The market melted down over the next few days of illiquid markets into Christmas Eve by about eight per cent. On January 4, 2019, speaking at the American Economic Association with Janet Yellen and Ben Bernanke on the stage, he took it all back. This is now known as the "Powell pivot" and markets fully recovered in the next few months. There was no inflation fight at the time, which is very different than today.

Given how sensitive they are to “financial conditions” (combination of credit and equity market measurements), where the markets are on Wednesday probably dictate what they do. If the S&P 500 is near or below last week’s low of 3808.86, they likely pause using financial conditions as the reason. If the market is above the post-Silicon Valley Bank shock high of 4017.81, they likely hike 25 bps. We will likely be somewhere in the middle of the range and I would expect a dovish rate hike not unlike what the European Central Bank did last week. The current survey of economists does not yet reflect the activity over the weekend. We do note a more cautious tone from some economists Monday morning leaning towards an uncertainty related pause this week.

If they pause, risks asset should initially rally with gold likely leading. This is not what the FOMC wants to see as it makes their inflation fighting job harder if financial conditions ease too much. But the credit concerns in banks will most likely tighten lending standards and do some of the work that higher rates try to accomplish. A dovish rate hike with forward guidance leaning towards a pause if conditions warrant, is likely the better option big picture. In either case, this is not likely the end of the bear market environment. Historically, the bear market does not end until there is some economic pain (read job losses) on Main Street forcing them to ease. While the bond market thinks that comes soon, we do not unless equities are significantly weaker. Both markets can’t be correct.

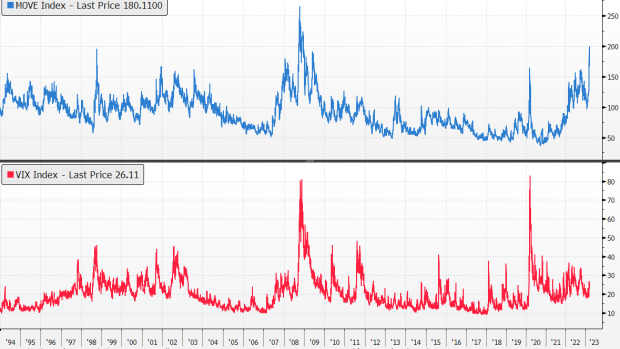

Investors can expect two-way volatility to remain elevated. In the bond market, volatility is about as high as it has ever been. In equities, it’s not even close. When looking to buy this week, ask yourself the question, have equites ever bottomed with volatility so low? If you are a day trader, there is a trade to make here, as there are enough oversold indications. If you are a nervous investor with cash on the sidelines, history suggests we are not there yet for a sustainable bottom.

Follow Larry online:

Twitter: @LarryBermanETF

YouTube: Larry Berman Official

LinkedIn Group: ETF Capital Management

Facebook: ETF Capital Management

Web: www.etfcm.com