Feb 11, 2021

Expedia misses estimates in sign of lingering COVID effects

, Bloomberg News

Notable Calls: Cascades, Teck Resources and Expedia

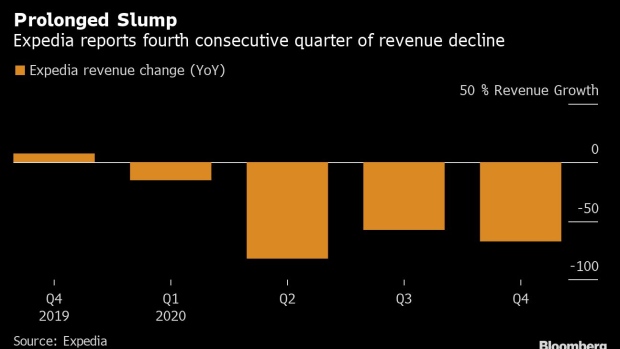

Expedia Group Inc. reported another steep drop in revenue in the fourth quarter, missing analysts’ estimates amid a surge in COVID-19 cases and new pandemic-related restrictions that weighed on travel in the last few months of last year.

Revenue fell 67 per cent to US$920 million, marking the fourth consecutive year-over-year decline. Analysts had projected sales of US$1.1 billion, according to data compiled by Bloomberg. Gross bookings were US$7.6 billion, also down 67 per cent compared with a year earlier, the Seattle-based online travel giant said in a statement Thursday, barely an improvement from the previous quarter’s 68 per cent decline.

Before 2020, Expedia, which provides everything from airline tickets to hotel rooms, rental cars and cruises, had gone eight years without a revenue decline. But the travel industry was one of the worst hit as a result of the coronavirus and the global lockdowns, forcing Expedia and its peers to endure steep losses and eliminate thousands of jobs. While the summer months seemed to offer a brief respite and saw people beginning to take tentative steps back into travel, the fall and winter saw a resurgence of infections, prompting a new wave of lockdowns and travel restrictions.

The holiday spike in cases is now on the decline and the vaccine rollout is underway, but Expedia may take longer to see an unleashing of pent-up travel demand.

“The fourth quarter brought signs of hope in the form of vaccine approvals, but rising cases across the globe and rolling shutdowns of various travel markets made an impact,” Chief Executive Officer Peter Kern said in the statement. As a result, the fourth quarter didn’t “show any real sequential progress other than some signs of modest improvement around the holidays that carried into the early part of 2021.”

There are early indications that the market could improve later this year. Dr. Anthony Fauci, the nation’s top infectious disease doctor, said Thursday that an increasing supply of vaccines will allow for a “much more of a mass vaccination approach” in the U.S. by April. Expedia withdrew its full-year forecast in March when lockdowns halted flights and travel globally.

Analysts at Deutsche Bank wrote in a note to investors that the first half of the year “is going to be tougher than we previously expected given the scale of rising case counts globally,” but vaccines should help with demand in the second half.

Expedia’s home-rental unit Vrbo, which competes with Airbnb Inc., has weathered the pandemic relatively better than its parent, partially offsetting declines in other segments. While flights and business travel ground to a halt and hotels shuttered, demand increased for regional vacations and work-from-home getaways. Analysts at Wedbush Securities said there is “pent-up demand for travel overall and untapped demand for alternative accommodations in particular.”

Also this year, Expedia should start to benefit from painful restructuring measures it took last year, including eliminating 3,000 jobs. The cost-cutting effort may help the company moving into the second half, said Bloomberg Intelligence analyst Matthew Martino.

Expedia reported an adjusted loss before interest, taxes, depreciation and amortization of US$160 million, while analysts were expecting a loss of US$56.3 million. The adjusted loss per share was US$2.64, beating the average analyst estimate of a loss of US$2.06.

The shares were little changed in extended trading in New York after closing at US$149.91. The stock has gained 13 per cent this year.