Oct 4, 2022

Extreme Treasury Positioning Shows Short Squeeze Has Room to Run

, Bloomberg News

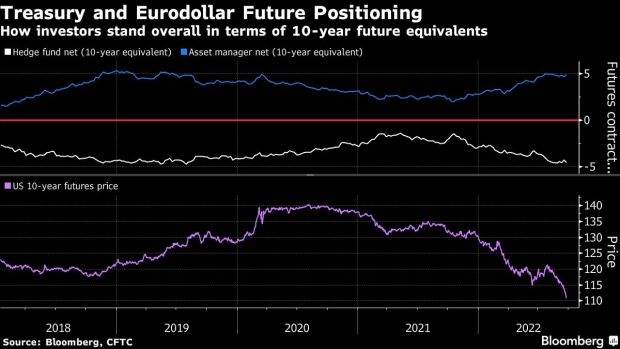

(Bloomberg) -- Hedge funds increased already elevated net short positions on US Treasuries last week, fueling a rout that sent 10-year yields to 4% for the first time in more than a decade.

The shift fueled short squeeze price action, with Treasuries already under pressure amid thinning liquidity and fears of more aggressive Federal Reserve rate increases. The 10-year yield surged to the highest since 2008 last week, before tumbling back after the Bank of England resumed buying long-dated bonds.

The latest JPMorgan Treasury client survey showed a small reduction in short positions in cash, while in options the call/put skew in 10-year futures has shifted closer to neutral, indicating potential hedging of short positions via demand for call structures.

The following is a rundown of how positioning unfolded in various markets through Monday.

Getting Short

Hedge funds were net sellers of duration by around 319,000 10-year note futures equivalents in the week through Sept. 27, which appeared to lead the cash 10-year yield rise to test the 4% level. After aggressive short covering in the previous week, hedge funds were back adding to short positions across most tenors in Treasury futures. On the flip-side, asset managers added around 210,000 10-year futures equivalent to net long position across most maturities.

Hedge funds mostly added to net short positions in both 10-year note contracts ($11.2 million per basis point risk) and ultra-long bond futures ($8.2 million per basis point risk). Asset managers were most active in 10-year notes and ultra-long bond futures also, where net longs were added to over the week.

Front-end Chop-Out

US futures risk was added over past week in all contracts except two-year note futures, where the 78,271 futures drop equates to approximately $3 million per basis point risk. Largest amount of risk was added to 10-year note futures as yields ranged from 3.68% to 4.015% over the week.

Strong Blocking

Block trades were active over the week, with most activity seen in 10-year note futures where around $4.4 million per basis point printed. Highlight of the week was a 25,000 10-year futures block on Sept. 26 which printed at a level of 111-15, consistent with a buyer with 10-year yields around 3.87%.

Bearish Skew Vanishing

Into the recent rebound in Treasuries, the premium paid to cover a continued rise in yields has been reduced as call/put skew moves closer to neutral from the previous week, when it favored a premium for put options. This may indicate covering of duration shorts via the options market and demand for calls over puts.

Outstanding open interest in December 10-year Treasury options shows a cluster of puts forming around the 108.00 to 111.00 strikes, equivalent to around 4% to 4.40% in 10-year yields. Meanwhile, most elevated open interest is at the 116.00 strike (47k calls and 29k puts) which is equal to approximately 3.25% 10-year yield.

©2022 Bloomberg L.P.