Jul 31, 2020

Exxon, Chevron earnings gutted by virus-driven demand slump

, Bloomberg News

Wall Street expected Exxon Mobil Corp. and Chevron Corp. earnings to be bad, but not this bad.

America’s biggest energy companies delivered their worst set of quarterly results of the modern era, weighed down by the slump in oil prices and the global collapse in demand due to COVID-19.

But even so, the extent of what was disclosed Friday was at certain points almost breathtaking. Chevron announced multibillion dollar writedowns on its assets for the second time in a year, said it will cut the equivalent of 5 per cent of its worldwide output during the current quarter and backtracked on plans to massively ramp up production from its prized Permian Basin shale holdings.

Exxon, not so long ago considered an almost unassailable profit-making machine, told investors its ambitious slate of expansion projects will be delayed and revealed it had failed to generate any operating cash flow in the second quarter.

“I was looking at the press release and was like, ‘Is that a typo?’” Jennifer Rowland, an analyst at Edward D. Jones & Co. in St. Louis, said of the lack of cash flow. “It’s mind-boggling for a company the size of Exxon.”

The woes of the U.S. supermajors are emblematic of the broader threats -- economic, political and structural -- to the petroleum industry in what’s turning into to the most serious crisis of its 161-year history. Having raked in record-breaking profits during the first decade of the century, both companies have been reduced to widespread job cuts, belt-tightening and heavy borrowing to cover dividends and other outlays.

Chevron’s shares dropped as much as 5.5 per cent while Exxon fell by as much as 2.3 per cent, in marked contrast to Friday’s rally by Big Tech following a set of bumper earnings from the likes of Facebook Inc. and Apple Inc. Energy is the worst investment in the S&P 500 Index this year.

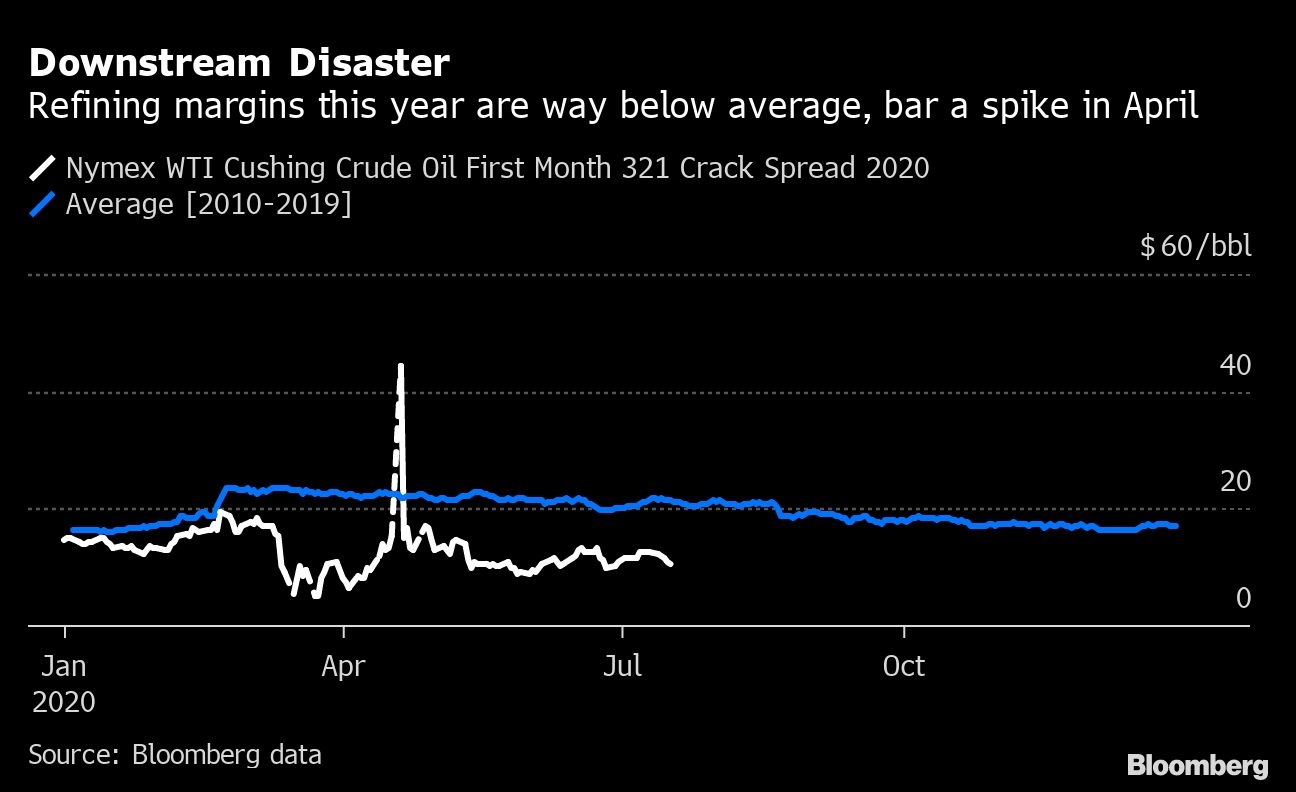

Exxon’s US$1.1 billion second-quarter loss was the deepest since its 1998 merger with Mobil Corp. The crude price crash during the quarter bled the company’s production division while COVID-19 lockdowns lowered demand for everything from jet fuel to plastic wrap, hobbling the company’s refining and chemical units.

The company had already announced this year it was taking steps to reduce its U.S. workforce, and on Friday it said it’s developing plans to further curtail operating expenses, without providing details. Exxon’s 26-cents per-share loss was better than the 64-cent average loss from analysts in a Bloomberg survey.

The worst-ever oil crash came at a vulnerable time for Exxon because it had just embarked on an aggressive, multibillion-dollar rebuilding program. After slashing $10 billion in capital spending and freezing dividends, Chief Executive Officer Darren Woods may be running out of levers to pull. On Friday, Woods told investors and analysts on a conference call that, based on current projections, the company won’t take on any additional debt.

What Bloomberg Intelligence Says

Leverage has gone to levels not seen in recent downturns and management’s comments that it doesn’t plan to take on more leverage could indicate that a protracted recovery would force the company to cut spending further, or even its vaunted dividend.

-- Fernando Valle, BI analyst

Chevron meanwhile recorded its weakest performance in at least three decades and warned that the global pandemic wreaking havoc upon energy markets may continue to drag on earnings.

Without the massive trading operations that shielded European oil explorers such as Royal Dutch Shell Plc and Total SE from losses, Chevron was exposed to the full force of this year’s oil price rout. Notably, Exxon’s nascent trading foray “experienced unfavorable mark-to-market derivative impacts,” the company said.

Chevron fully erased the value of its Venezuela operations from its books, amounting to US$2.6 billion, after they were effectively frozen by U.S. sanctions, and wrote down another US$1.8 billion in assets due to lower commodities prices.

Even stripping out the impairments, Chevron’s adjusted loss was US$3 billion, more than twice the average analyst estimate in a Bloomberg survey and the deepest since at least 1989.

Earnings Bloodbath

“While demand and commodity prices have shown signs of recovery, they are not back to pre-pandemic levels, and financial results may continue to be depressed into the third quarter 2020,” Chevron said in a statement.

Venezuela and low prices aside, Chevron also had a one-off charge of US$780 million related to its plan to cut 6,000 jobs, or about 13 per cent of its workforce.

Despite the red ink, Chevron CEO Mike Wirth saw an opportunity for expansion amid the rout: The US$5 billion, all-stock takeover of Noble Energy Inc. announced less than two weeks ago. The deal comes at a minuscule premium and plugs holes in Chevron’s long-term portfolio, analysts noted.

--With assistance from Rachel Adams-Heard and Laura Hurst.