May 8, 2018

FAANG investors appear torn as big ETF trades signal split views

, Bloomberg News

For some investors, the FANG trade is back.

High-flying technology stocks have lured back buyers, as Facebook Inc. has recovered much of what it lost in market value amid its data privacy controversy.

The Technology Select Sector SDPR Fund, known by its ticker XLK, saw two massive block trades Tuesday. Investors bought a combined 3 million shares of XLK worth $202 million between the two trades, the largest intraday transactions this year, according to data compiled by Bloomberg.

“The trading action says, ‘Oh, they got cheap,’” Matt Lloyd, chief investment strategist at Advisors Asset Management, said by phone. “When you look at technology, with the pullback that they had, it was a great opportunity for traders.”

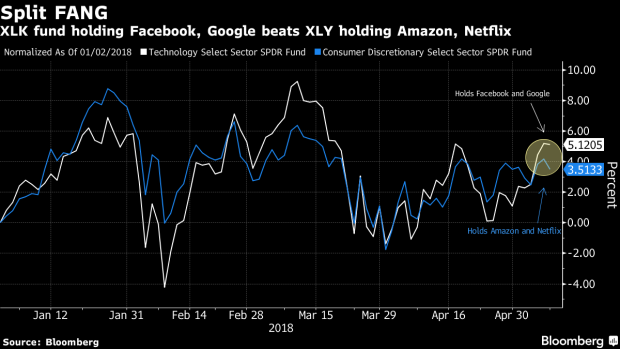

XLK has a 10.1 percent exposure to Google’s parent Alphabet Inc. and 6.8 percent exposure to Facebook. But that’s just two of the four tickers commonly strung together to make up the FANG group. The fund does not hold any shares of Amazon.com Inc. or Netflix Inc.

Meanwhile, Amazon and Netflix do make up large holdings for the Consumer Discretionary Select Sector SPDR Fund, known by its ticker XLY. Investors watching those names seem less convinced by the group, with XLY absorbing two large block sales today. Investors sold just under 1 million shares in two trades worth a combined $102 million. Amazon makes up almost 22 percent of the fund’s exposure as its top holding, while Netflix has close to a 5 percent weight.

--With assistance from Tom Lagerman (Global Data).

To contact the reporters on this story: Carolina Wilson in New York City at cwilson166@bloomberg.net, Sarah Ponczek in New York at sponczek2@bloomberg.net.

To contact the editor responsible for this story: Courtney Dentch at cdentch1@bloomberg.net.

©2018 Bloomberg L.P.