Jan 28, 2022

Fallen Angel ETFs Lose Cash as Investors Weigh Hawkish Fed

, Bloomberg News

(Bloomberg) -- Investors are abandoning ETFs that bet on a rebound in junk-rated corporate bonds, in a potential credit-market warning that the Federal Reserve’s hawkish shift threatens to undercut the economic recovery.

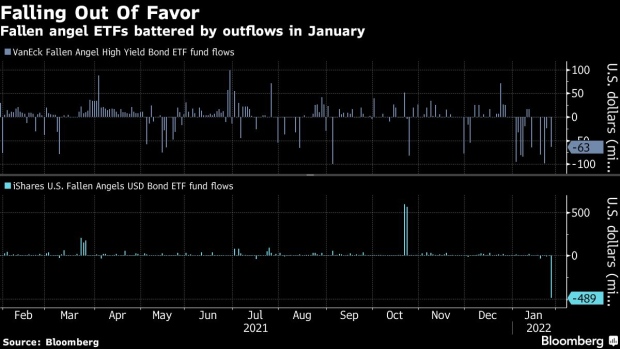

After booming in 2021, U.S. exchange-traded funds buying fallen angels -- debt that has been recently downgraded from investment-grade status -- are notching serious outflows.

The two major products, the $4.6 VanEck Fallen Angel High Yield Bond ETF (ticker ANGL) and the $4.3 billion iShares U.S. Fallen Angels USD Bond ETF (FALN), have now posted a combined $1.1 billion of redemptions this month, Bloomberg data show. A record $489 million was pulled from FALN on Thursday.

While it’s been a crowded Wall Street trade over the past year, the trend looks worrisome for credit bulls. The hawkish Fed tilt could stem the tide of rating upgrades seen last year, after stimulus and the end of lockdowns fueled a rebound in U.S. companies most battered by the pandemic.

“I don’t think we’ve hit a stage where people have given up on upgrades, but if you think the Fed is going to slow things down too quickly, then the upgrade trade falls into question,” said Peter Tchir, head of macro strategy at Academy Securities.

Risk premiums in credit markets have so far largely weathered the rout in global equity markets. But rising U.S. yields are hurting all-in returns across bonds, particularly in the world of fallen angels.

ANGL and FALN have lost 4.3% and 4.2% so far in 2022, respectively, exceeding year-to-date losses in both the $35.3 billion iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) and $17.5 billion iShares iBoxx High Yield Corporate Bond ETF (HYG).

Part of the problem for ANGL and FALN is how popular they’ve been, Tchir said. Both funds posted record inflows last year, fueled by blockbuster corporate earnings and robust economic growth.

“Playing the ‘upgrade’ cycle became a very crowded trade,” Tchir said.

©2022 Bloomberg L.P.