May 15, 2019

Fear of Election ‘Bolt From the Blue’ Has India Markets Worried

, Bloomberg News

(Bloomberg) -- Investors in India are bracing for an extreme event risk next week: Prime Minister Narendra Modi failing to retain power.

The optimistic tone for the nation’s assets has fizzled out as the trade impasse combines with concern about Modi’s ability to repeat his landslide 2014 victory amid a resurgent opposition, farm distress and a job crisis. A result that upsets the market’s base case view -- the ruling party winning with a slim majority -- could lead to an adverse reaction, analysts say.

“At a time when the trade spat has roiled risk assets globally, a worst outcome will be like a bolt from the blue,” said Anindya Banerjee, currency strategist at Kotak Securities Ltd. in Mumbai. “India will see outflows from both stocks and bonds, and the rupee could tumble to 75 per dollar and more.”

The currency, Asia’s top performer in March, has fallen 1.6% to 70.34 since President Donald Trump’s tweets rekindled the trade spat with China earlier this month. The S&P BSE Sensex Tuesday halted a nine-session losing streak, avoiding the longest-ever stretch of losses, only to decline again on Wednesday as sentiment remains fragile.

Still, India remains Asia’s top destination for overseas money this year outside China, with net stock inflows of $9.8 billion.

Below are charts showing where markets stand as the world’s largest democracy gets ready to elect a new government on May 23.

Rupee

The currency may remain weak going into the vote-counting day, given that Modi’s re-election bid looks strained after the ruling party’s electoral losses in three states in December, according to ING Groep NV.

“This is still close to call, and judging from what happened in key state elections in late 2018 things could go against Modi, which would reignite the selling pressure on the rupee,” said Prakash Sakpal, an economist at ING in Singapore. Still, Sakpal said his base case view remains that of Modi winning with a reduced majority.

Here are other rupee forecasts:

Bonds

The yield on benchmark 10-year government bonds has dropped to a one-month low amid expectations the central bank will add to two rate cuts this year and bump up purchases of bonds and forex swaps to ease a lingering cash crunch. Foreign outflows of more than $600 million from local debt seen this month may accelerate if polls deliver a fractured mandate.

“The possibility of a coalition or an unstable government coming to power is keeping the market fearful,” said B. Prasanna, group head- Global Markets –Sales, Trading and Research at ICICI Bank Ltd. “People have lined up funds and some are waiting for the results.’’

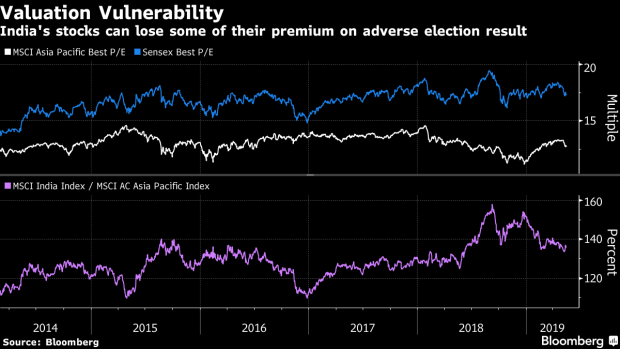

Stocks

Analysts expect India’s $2 trillion equity market to remain edgy as traders pare their positions before poll results, in addition to trade worries and cooling domestic economic activity. The caution is palpable: the India NSE Volatility Index has surged to its highest level since September 2015, with the bulk of the ascent coming in over the past month.

“We have seen a bottom with the negative sentiment relating to the U.S.-China trade spat, and a favorable outcome -- the BJP-led coalition returning -- will help the market stabilize and reinstate confidence,” said Sanjiv Bhasin, executive vice president at IIFL Securities Ltd. in Mumbai.

--With assistance from Ravil Shirodkar.

To contact the reporters on this story: Kartik Goyal in Mumbai at kgoyal@bloomberg.net;Nupur Acharya in Mumbai at nacharya7@bloomberg.net

To contact the editors responsible for this story: Tan Hwee Ann at hatan@bloomberg.net, ;Divya Balji at dbalji1@bloomberg.net, Ravil Shirodkar, Anto Antony

©2019 Bloomberg L.P.