Apr 20, 2023

Fed Emergency Loans to Banks Post First Rise in Five Weeks

, Bloomberg News

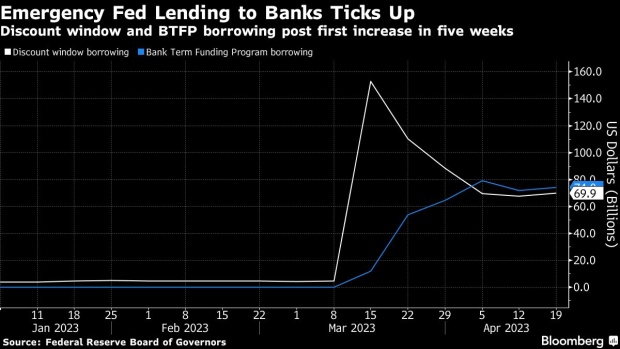

(Bloomberg) -- Banks increased emergency borrowings from the Federal Reserve for the first time in five weeks, indicating that financial stresses are lingering after a string of bank collapses last month.

The US central bank had $143.9 billion of loans outstanding to financial institutions through two backstop lending facilities in the week through April 19, compared with $139.5 billion the previous week, according to data published Thursday.

The weekly Fed balance sheet data showed $69.9 billion of outstanding borrowing from the central bank’s traditional backstop lending program, known as the discount window, compared with $67.6 billion the previous week and the record $152.9 billion reached last month.

Demand in the new Bank Term Funding Program also climbed, rising to $74 billion, compared with $71.8 billion the previous week.

The discount window is the Fed’s oldest liquidity backstop for banks. The BTFP, meanwhile, was launched March 12 after the Fed declared emergency conditions following the collapse of California’s Silicon Valley Bank and New York’s Signature Bank.

Fed loans to bridge banks established by the Federal Deposit Insurance Corp. to resolve SVB and Signature Bank were unchanged at $172.6 billion.

Foreign central banks had $20 billion outstanding in the Fed’s Foreign and International Monetary Authorities repurchase-agreement facility, declining from $30 billion.

(Updates with chart.)

©2023 Bloomberg L.P.