Sep 26, 2022

Fed Hikes Harming Global Markets, Economy, Ex-PBOC Official Says

, Bloomberg News

(Bloomberg) -- The US Federal Reserve’s most aggressive interest-rate hike cycle since the 1980s is destabilizing global financial markets and harming other economies, a former Chinese central bank official warned.

The Fed’s decision to lift interest rates sharply to combat stubbornly high inflation is weakening many major currencies and spurring capital outflows from developing countries, Sheng Songcheng, a former director of the People’s Bank of China’s statistics and analysis department, said in an interview.

“The spillover effect of the Fed’s interest rate hikes has triggered many deep-rooted problems in the global economic and financial system,” said Sheng.

The dominant global status of the dollar means many central banks are forced to raise interest rates following the Fed, even if economic activities in those countries are under pressure or their domestic inflation remains soft, he said.

The Fed’s hawkish stance and the dollar’s surge has roiled global financial markets as risks of a world recession mount. Sheng’s comments underscore heightened concern in Beijing about the spillover effects on China’s economy as the PBOC keeps monetary policy relatively loose to boost a slowing growth.

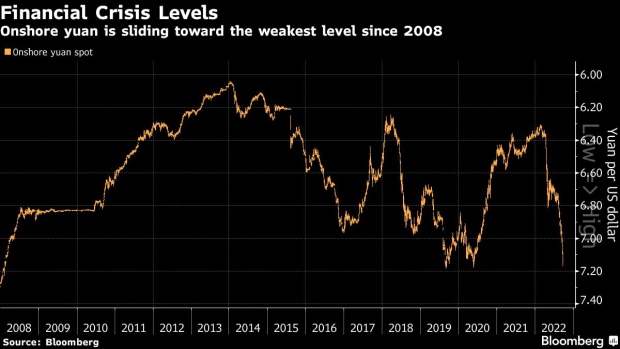

The onshore yuan is sliding toward 7.2 per dollar, a level it hasn’t reached since 2008, with the PBOC stepping up its defense of the currency in recent weeks.

CHINA INSIGHT: PBOC Tinkering Won’t Stop Yuan in USD Vortex

The Fed’s current policy is “harming others without benefiting itself,” as rate hikes are not as effective in taming US inflation but rather increase the risk of a recession, according to Sheng. He argues the Fed should accelerate shrinking its balance sheet at the same time as raising rates, which could achieve a better effect of containing inflation and reducing recession risks.

Factors that supported a worldwide low-inflation environment in the past such as globalization are waning, while the pandemic and climate change has led to higher operation costs for companies, according to Sheng. Consecutive big interest rate hikes are worsening the burden of companies that need to borrow, he said.

©2022 Bloomberg L.P.