Oct 14, 2022

Fed Is Set to Target Even Higher Rates as Inflation Stays Stubborn

, Bloomberg News

(Bloomberg) -- Federal Reserve officials are likely to once again raise their outlook for how high they’ll have to lift interest rates following the latest bout of bad inflation news.

Several Fed policymakers have said they want to see a decline in core inflation, a measure excluding volatile food and energy prices, before they slow the pace of rate increases.

But data released Thursday showed the numbers continue to go in the opposite direction, with the core consumer price index climbing 0.6% for a second month and increasing 6.6% from a year ago, the highest level since 1982.

That hardened bets officials will roll out another significant rate hike next month, and could signal they’ll need to bring rates higher than they previously expected before they can take a pause. It would be the latest upward revision to estimates for the peak of this tightening cycle as policymakers fight to control price pressures.

All three of their quarterly projections this year have shown a shift higher in the peak rate, starting in March when they began raising borrowing costs from nearly zero. The next forecast publication is mid-December, but officials will have plenty of opportunity between now and then to drive expectations further north.

“They’re going to have to go a lot higher,” said Steven Blitz, chief US economist for TS Lombard. “The trend that you see in terms of broad-based inflation is that it’s not decelerating.”

Kansas City Fed President Esther George, San Francisco’s Mary Daly and Fed Governor Lisa Cook have the chance to reflect on how the inflation report affects their outlooks when they speak at separate events Friday.

Policymakers last month projected rates rising to around 4.5% and staying there for some time to get inflation on track to return to the Fed’s 2% target. With their benchmark rate in a target range of 3% to 3.25%, that implied a downshift in the pace of rate increases in coming months after a string of 75 basis-point moves.

But with core price gains persisting, US central bankers could be signaling by early next year that they’re willing to get interest rates as high as 5.5% to get inflation down, Blitz said.

Fed officials point to the economic projections released after their Sept. 20-21 meeting as the best guide for where they see interest rates headed. But they are also careful to say that the forecasts are not a commitment and their views will evolve as they learn more about how the economy is behaving.

What Bloomberg Economics Says

“What’s really at play in the September CPI is the December FOMC meeting, and the news is not good. The higher-than-expected CPI print will make it difficult for the Fed to slow down to a 50-basis-point hike at its last meeting of the year, as it indicated in the latest dot plot that it wants to do.”

-- Anna Wong and Andrew Husby (economists)

To read more click here

“As we go forward, of course we’re going to always be looking at what is the incoming data and economic information that we’re getting from our contacts telling us about where the economy is headed,” Cleveland Fed President Loretta Mester told reporters on Tuesday.

Mester said officials would adjust policy if inflation comes down faster than they anticipated. “On the other hand, if inflation doesn’t come down and we see that the pressures are still increasing, then that will help me evaluate where policy is as well,” she said.

Policymakers will get October and November consumer price readings before their Dec. 13-14 policy meeting.

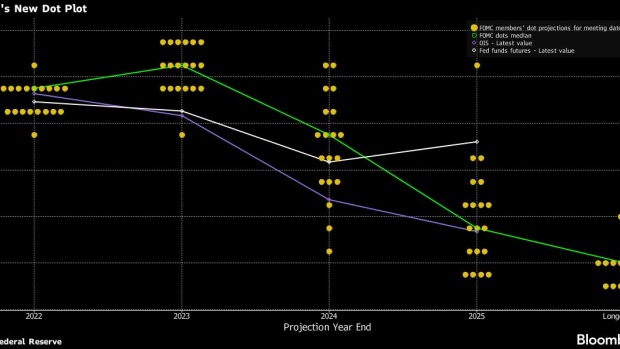

If history is any guide, officials could forecast a higher terminal rate when they meet in December. A look at officials’ previous projections shows they have raised their expectations for how high they think rates will need to go with each update this year.

Six of the Fed’s 19 policymakers forecast the upper boundary of their target range for rates would reach 5% next year, according to estimates published in September. But in June, the highest projection called for a target range with an upper bound of 4.5% in 2023, and only one Fed official penciled that in. In March, the most hawkish officials saw rates reaching an upper bound of 3.75% next year.

The evolution of the Fed’s “dot plot,” as its known, illustrates how much officials have ramped up their efforts in the wake of surprisingly strong inflation. And with no relief in sight, Fed watchers say the central bank is likely to keep making big moves.

Investors expect Fed officials to raise rates by 75 basis points for the fourth straight time when they meet in early November with the same-sized move on the table for December, continuing the most aggressive tightening cycle since the 1980s.

With the unemployment still low, the latest inflation reading suggests Fed officials may need to raise rates closer to 5% before they can pause, said Tiffany Wilding, North America economist for Pacific Investment Management Co.

The Fed could consider slowing down or stopping the hikes next year if the US unemployment rate moves up and the economy contracts, she said. However, she said it would take significant labor market weakness for the Fed to back down.

Fed officials saw the jobless rate rising to 4.4% by the end of next year, according to the projections they released in September. It was 3.5% last month.

But Wilding said the rate may need to rise more, closer to 5%, for inflation to come down significantly.

“The Fed frankly needs to see some labor market weakness in order to be more assured that inflation’s going to come down,” she said.

©2022 Bloomberg L.P.