Feb 20, 2019

Fed minutes to shed light on biggest policy reversal in years

, Bloomberg News

It was a big reversal: Federal Reserve officials pivoted last month toward keeping interest rates on hold, and now minutes of their meeting may shed light on just how long.

The Federal Open Market Committee pledged in its January statement to “be patient’’ on the timing of future rate “adjustments.” That backed away from the “some further gradual increases’’ it highlighted in December and left open whether the next move is up or down. Minutes of the Jan. 29-30 meeting are scheduled to be released at 2 p.m. in Washington.

“I really want them to define patience a little more systematically’’ in terms of what data would cause them to move or hold, said Derek Tang, an analyst at Monetary Policy Analytics in Washington. “Some color there would be helpful.’’

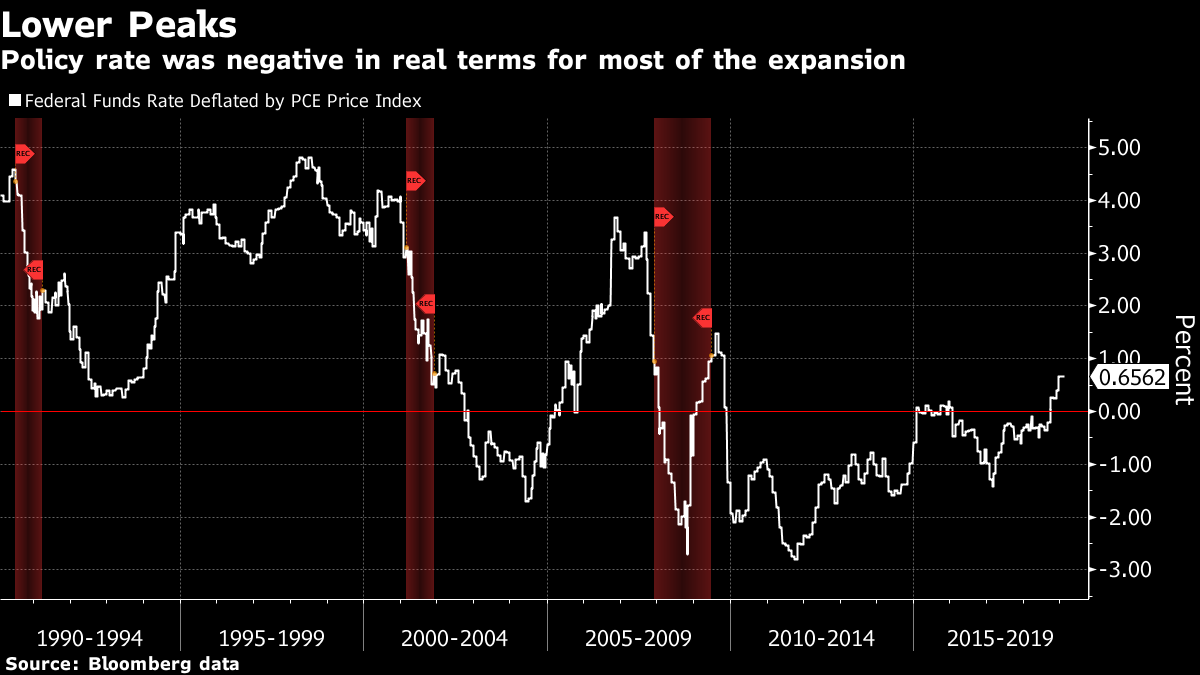

Investors will search for clues on whether the Fed is near the peak of its tightening cycle. The current 2.25 per cent to 2.5 per cent target for the benchmark federal funds rate is at the bottom of their range of estimates for the neutral rate that neither speeds up nor slows the economy. Investors see rates staying on hold all year and lean toward a cut in 2020, according to pricing in interest-rate futures.

The Fed’s balance sheet policy also probably played a large role in the discussions. Officials issued a separate statement last month committing to an operational strategy of abundant bank reserves, which means a bigger balance sheet than would otherwise the case.

They also said they would be flexible in shrinking their holdings of Treasuries and mortgage-backed securities, depending on the economy. That was a shift from their previous guidance that they’d be prepared to resume asset purchases if the economy weakened to the extent that it warranted a big cut in rates.

But they were silent on when they’d cease the rolloff, though a couple of officials have since said they’re open to halting this year.

“We are going to get a sense of the landing point” for the balance sheet, said Julia Coronado, president and founder of MacroPolicy Perspectives LLC in New York, referring to a stopping point in the rundown of bank reserves. “The minutes are likely to send a signal that the end of the reduction in the Fed’s Treasury portfolio could come as early as April.”

The current pace of rolloffs, capped now at US$50 billion per month, was criticized by some Fed watchers as “quantitative tightening,” a play on the quantitative easing description given to the central bank’s emergency asset purchases to protect the economy from the Great Recession.

Another source of critical information from the minutes will be how officials discuss risks. Chairman Jerome Powell said in his Jan. 30 press conference the shift in the statement was not driven by a change in the outlook, but by the risks that it faces. He noted that inflation pressures were “muted,” that growth was slowing in China and Europe, that Brexit remained unresolved and that financial conditions were tighter.

Just how these risks will impact officials’ outlook for U.S. growth could provide insight into how long the Fed will be on hold.