Nov 15, 2018

Fed Officials Preach Policy Caution as World Economy Downshifts

, Bloomberg News

(Bloomberg) -- Slowing global growth is getting the Federal Reserve’s attention.

Two regional Federal Reserve bank presidents on Thursday cited cooling activity abroad as they urged caution in raising interest rates. Their remarks echoed Chairman Jerome Powell the day before, who called signs of a global slowdown “concerning” and included it among headwinds facing an otherwise strong U.S. economy.

Atlanta Fed President Raphael Bostic, a voting member this year of the central bank’s rate-setting Federal Open Market Committee, said ignoring weaker growth abroad was a “recipe for a policy mistake” though he did appear to back some further policy tightening.

“I don’t think we are too far from a neutral policy, and neutral is where we want to be,” Bostic told a conference in Madrid, referring to the level of rates that neither spur nor slow economic activity. “We may not be there quite yet, but I am inclined to think that a tentative approach as we proceed would be appropriate.”

Minneapolis Fed President Neel Kashkari, who has advocated against raising rates to give the labor market more room to run, said it was hard to know if slower growth abroad was a temporary trend.

“Right now, the U.S. economy seems to be the strongest engine of the major economies around the world -- is that going to last, especially if the Fed keeps raising rates? It’s hard to know.”

The economies of Germany and Japan both contracted in the third quarter, though both are forecast to rebound in the final three months of the year.

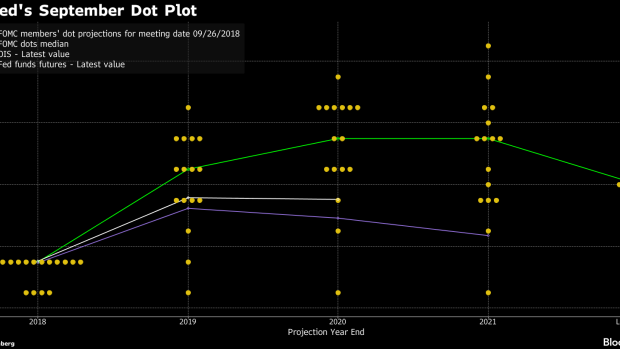

The Fed has raised rates three times this year and has penciled in another move in December followed by three increases in 2019, according to forecasts in September. These quarterly projections will be updated next month. Investors see a more than 70 percent likelihood the Fed will hike in December.

The Fed’s benchmark rate target range is currently 2 percent to 2.25 percent. The neutral level is estimated at about 3 percent, according to policy makers’ projections, though almost half the participants put the rate at 2.5 percent or 2.75 percent.

“I can think of no superior approach than to proceed cautiously and keep a keen eye on the data,” Bostic said.

--With assistance from Charlie Devereux.

To contact the reporters on this story: Steve Matthews in Atlanta at smatthews@bloomberg.net;Jeanna Smialek in New York at jsmialek1@bloomberg.net

To contact the editors responsible for this story: Brendan Murray at brmurray@bloomberg.net, Alister Bull

©2018 Bloomberg L.P.