Mar 23, 2022

Fed Officials Take Aim at Inflation, Say Ready to Act With Vigor

, Bloomberg News

(Bloomberg) -- Federal Reserve officials said Americans should take them at their word that they will curb inflation and repeated that a 50 basis-point increase in interest rates is on the table for their next meeting in May.

“If we need to do 50, that is what we’ll do,” San Francisco Fed President Mary Daly told the Bloomberg Equality Summit Wednesday, adding she’d also back a 25 basis-point increase if that’s what was necessary. “We’re prepared to do whatever it takes to ensure that we get price stability, which clearly no one thinks we have right now.”

Investors have increased bets on a half-percentage point hike at the Fed’s May 3-4 meeting after Chair Jerome Powell said on Monday the central bank was prepared to take such a step if necessary to control the hottest price pressures in 40 years.

Other officials have since lined up with Powell in stressing the need to confront inflation despite uncertainty caused by Russia’s invasion of Ukraine. Several are pushing to front-load policy action to cool the economy.

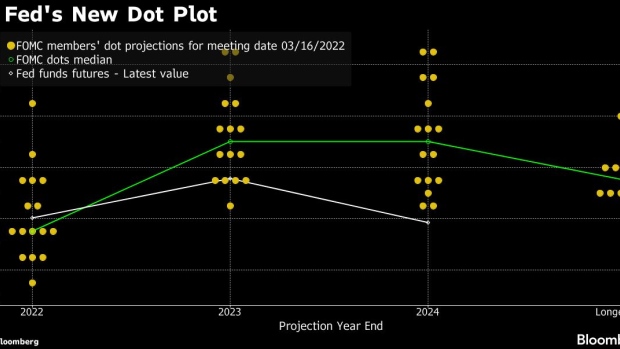

Fed officials raised rates by a quarter point last week for the first increase since 2018 and projected six more such hikes this year to 1.9%, rising to 2.8% by the end of 2023.

Cleveland Fed President Loretta Mester, who favors raising rates to 2.5% this year, said earlier Wednesday that the Fed will “need to do some 50 basis-point moves” to get there. “I don’t want to presuppose every meeting from here to July, but I do think we need to be more aggressive earlier rather than later.”

Mester is a voter this year on the rate-setting Federal Open Market Committee.

The consumer price index soared 7.9% in February, the most since 1982; the Fed’s 2% inflation target is based on a separate gauge, the personal consumption expenditures price index, which rose 6.1% in the 12 months through January.

St. Louis Fed chief James Bullard, who projects rates above 3% by the end of the year, told a separate audience that officials should move faster because the fallout from the pandemic has caused significant supply-demand imbalances in the U.S. economy.

“We have to think bigger maybe than we have in the past,” he said. “The committee will have to make sure we maintain credibility on our inflation target.” Bullard, who dissented last week in favor of a half-point hike, pointed to the 1994-1995 tightening cycle as the template to copy.

From 1994 to early 1995, the Fed under Alan Greenspan raised rates from 3% to 6% and achieved a “soft landing” for the economy with inflation contained and continued strong growth. Powell, who has often praised Greenspan as a model, has cited the tightening as an example of his goal for the economy.

Bullard also wanted the central bank to commence shrinking its bloated $9 trillion balance sheet at last week’s meeting, a process that the fed chair told reporters could start in May.

Mester said she didn’t think that would be disruptive, even if the Fed raised rates at the same meeting.

“We have told the markets that we would let them know what the balance sheet process would look like,” she said. “I think given the situation we’re in and the communications that Chair Powell has already made about the balance-sheet process, I don’t have concerns that that would be destabilizing.”

©2022 Bloomberg L.P.