Sep 18, 2019

Fed Rate Cuts Couldn't Be More Timely for Economies Across Gulf

, Bloomberg News

(Bloomberg) -- While not everyone agrees that interest-rate cuts are warranted in the U.S., monetary easing by the Federal Reserve is making looser policy possible where it’s long overdue.

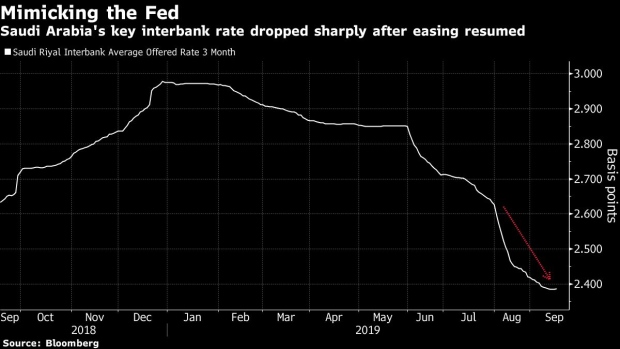

Gulf Arab central banks, which largely move in lockstep with the U.S. to protect their currencies’ peg to the dollar, are set to follow the Fed again if, as widely expected, it reduces rates on Wednesday for a second straight meeting. After a wallop of economic uncertainty in the wake of the attack on oil infrastructure in Saudi Arabia, monetary relief could hardly come at a better time.

“It’s a gift from the gods of the Fed,” said Marcus Chenevix, an analyst at investment research firm TS Lombard in London. “They’re suddenly allowed to loosen when the U.S. probably shouldn’t.”

Despite the economic upheaval after the crash in oil prices more than four years ago and the sluggish recovery that followed, Gulf policy makers held off on rate cuts until the Fed ended its extended tightening cycle and trimmed borrowing costs in July. That prompted central banks in Saudi Arabia, the United Arab Emirates, Qatar and Bahrain to cut their benchmark rates by 25 basis points. Kuwait, which maintains a peg to a basket of currencies, kept its discount rate unchanged at 3%.

In the days before the Fed’s meeting this week, the region’s biggest economy, Saudi Arabia, has also had to contend with the aftermath of the strike on the crucial Abqaiq oil facility. Top officials have insisted that the kingdom’s public finances have escaped unscathed. Still, central bank Governor Ahmed Abdulkarim Alkholifey is on the lookout for rates to fall.

“If interest rates are lowered, this will be an impetus for growth in the economy,” he said on Tuesday.

In the U.A.E., the second-biggest Arab economy that has struggled to shake off a slump in real estate, lower U.S. rates “could put downward pressure on the dollar and thus make dirham-denominated properties more affordable,” according to the Institute for International Finance.

- The impact of rate cuts on the banking systems across the Gulf will differ from country to country

- “Kuwaiti and U.A.E. banks have more flexibility than Saudi banks to pass lower rates to depositors as they have a greater share of interest-bearing deposits,” said Edmond Christou, a Dubai-based banking analyst with Bloomberg Intelligence

- Should rates stay unchanged in Kuwait again, “pressure on the cost of funding may continue to weigh on sector margins,” he said

A looser stance by central banks will ultimately be no match for government spending, meaning it’s the prospect of fiscal stimulus that could dictate the outlook in the Gulf, according to Mohamed Bardastani, a Dubai-based senior economist at Oxford Economics.

“Monetary policy often plays a secondary role in terms of driving the economic outlook,” he said “Fiscal policy has a much larger weight and is a traditional growth driver.”

To contact the reporter on this story: Abeer Abu Omar in Dubai at aabuomar@bloomberg.net

To contact the editors responsible for this story: Lin Noueihed at lnoueihed@bloomberg.net, Paul Abelsky, Claudia Maedler

©2019 Bloomberg L.P.