Aug 23, 2019

Fed’s Best Effort to Guide Rates Market Undone by Trade and Tantrums

, Bloomberg News

(Bloomberg) -- The Federal Reserve’s success in reassuring markets in Jackson Hole was a distant memory within minutes. Friday’s volley of acrimonious presidential tweets and a nastier turn in the trade war have set up what could be a week of reinvigorated demand for the perceived safety of Treasuries.

Hopes that the central bank could guide markets to a cool-headed assessment of the U.S. economy now look precarious. Chairman Jerome Powell had barely finished speaking at the Fed’s annual event Friday when President Donald Trump unleashed a Twitter tirade against his appointed Fed chief.

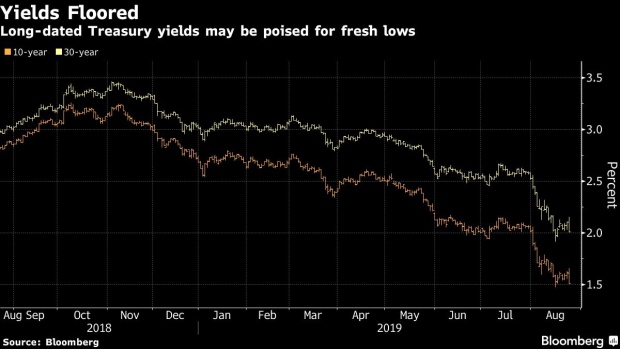

The 10-year yield slid back to 1.5% and stocks tumbled, as the leader of the world’s largest economy took to social media to order U.S. companies to start looking for alternatives to making products in China. And that’s before traders even get to hear the president’s promised response to China’s latest tariffs this afternoon, let alone what could be a tense Group-of-Seven gathering in France this weekend.

“One hundred percent of the focus for the next few days is going to be on the trade war,” said Gary Cameron, head of the U.S. rates team at Garda Capital Partners. “There’s going to remain a bid in U.S. Treasuries. It’s paid to buy the dip all year long.”

At this rate, the fixed-income portfolio manager expects that the Fed policy rate is headed to zero. He says markets are calling the path right for this year. As of early afternoon New York time, rate markets were priced for the Fed’s target rate to fall about 64 additional basis points by the end of December.

And in his view it’s not just the weight of global events dragging yields lower -- investors are also increasingly worried about cracks in the U.S. economy.

The risks were on display this week with U.S. purchasing managers indexes suggesting factory output may now be shrinking, and the dominant services sector barely expanding. That’s got investors worried about the rest of the year.

This is a tough set-up for what was starting just days ago to look like an auspicious time for investors calling the bottom in U.S. yields. The searing rallies of mid-August took long-dated yields to multi-year lows, including an all-time record for the 30-year.

“It’s hard to get rates much higher in the near-term really,” said Priya Misra, head of global rates strategy at TD Securities in New York. “Global growth and trade uncertainty seem to be here to stay.”

To contact the reporter on this story: Emily Barrett in New York at ebarrett25@bloomberg.net

To contact the editors responsible for this story: Benjamin Purvis at bpurvis@bloomberg.net, Mark Tannenbaum

©2019 Bloomberg L.P.