Oct 3, 2022

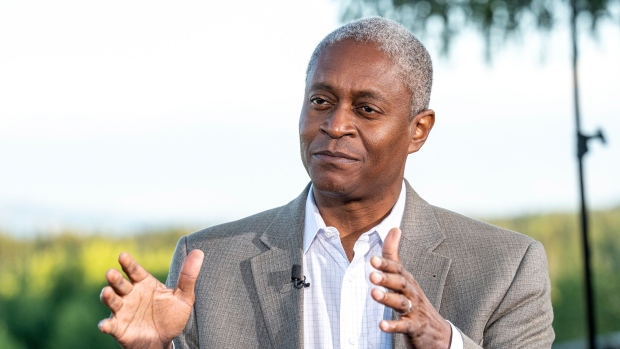

Fed’s Bostic Warns Supply-Chain Overhaul to Add Inflation Burden

, Bloomberg News

(Bloomberg) -- Federal Reserve Bank of Atlanta President Raphael Bostic said US manufacturers who have struggled with international supplies during the Covid-19 pandemic are shifting their component businesses nearer to home, which may reduce efficiency and add to inflationary pressures.

“Such a fundamental shift in global sourcing strategies would almost certainly put upward pressure on prices,” Bostic said Monday at a conference hosted by his bank on technology disruption. “Obviously, elevated inflation today is the most pressing issue facing monetary policymakers. And by creating long-term upward price pressure, then secular shifts in supply chain management could present additional challenges for monetary policymakers during a period of already elevated inflation.”

Bostic didn’t discuss his outlook for monetary policy in his remarks, which kicked off the two-day conference. Fed officials raised interest rates by 75 basis points on Sept. 21 for the third straight meeting as they confront inflation near a 40-year high, and forecast additional tightening by year’s end.

“In response to the effects of the pandemic and war in Europe, many businesses are at least contemplating a shift from just-in-time approaches to providing their goods, to just-in-case supply chain strategies,” Bostic said. “Businesses appear to be much more willing than at any point in the past 30 to 40 years to sacrifice efficiency and low cost to ensure production reliability and safety.”

Bostic described the labor market as “tight” and said that is one reason businesses are speeding the deployment of new technologies to reduce dependence on labor.

“Demographic patterns suggests labor supply is not likely to increase dramatically anytime soon,” he said.

©2022 Bloomberg L.P.