Jun 14, 2020

Fed's Powell to bring sober message to Capitol Hill this week

, Bloomberg News

Virus poses lasting harm to U.S. economy, Powell says

Federal Reserve Chairman Jerome Powell will deliver a cautionary message about the U.S. economy and COVID-19 when he appears twice this week on Capitol Hill.

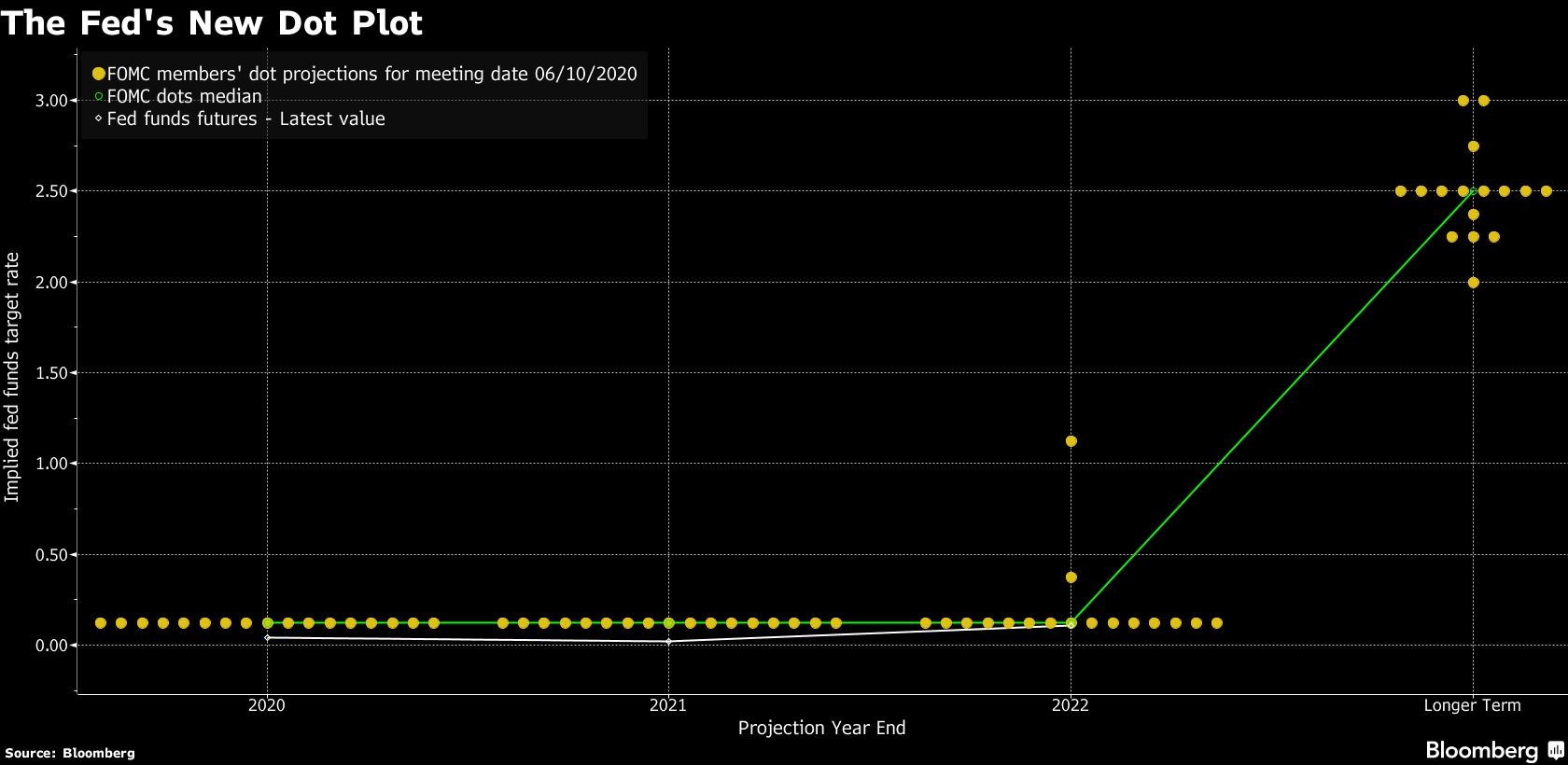

His remarks to lawmakers are widely expected to echo the mostly downbeat assessment he gave June 10 after policy-makers held interest rates near zero at a two-day meeting and signalled they’d probably stay there through 2022. His performance, which highlighted the hardships faced by millions of Americans who’ve lost work, drew criticism from a White House official for being overly negative.

“I can’t see him straying from that message,” said Jennifer Lee, a senior economist at BMO Capital Markets. “If he changes his tune in any way, people are going to be jumping all over it. Democrats will accuse him of bending to the political will of others.”

Powell will testify via video conference at 10 a.m. Washington time Tuesday before the Senate Banking Committee and at noon Wednesday to the House Financial Services Committee. Lawmakers will pose questions following Powell’s opening remarks. The appearance is connected to the Fed’s semi-annual monetary policy report to Congress, which the central bank published June 12.

With the U.S. economy beginning to emerge from pandemic-provoked shutdowns and despite recent economic data offering some surprisingly bright points, Powell last week emphasized how many Americans are out of work and how long it may take to heal the labour market, especially for minorities hit hardest by layoffs.

May Surprise

“The May employment report, of course, was a welcome surprise,” he told reporters during a virtual press conference June 10. “We hope we get many more like it, but I think we have to be honest, it’s a long road. Depending on how you count it, well more than 20 million people displaced in the labour market. It’s going to take some time.”

The Labor Department’s May payrolls report showed unemployment fell to 13.3 per cent from 14.7 per cent when economists were predicting an increase to 19 per cent. The Labor Department added, however, that as many as five million people had been miss-classified in their surveys and the actual unemployment level was likely three percentage points higher. But that was still much better than expected.

Powell’s take represented a stark contrast to the reaction from President Donald Trump, who characterized the jobs report as the “greatest comeback in American history.” Trump faces a difficult re-election test in November when unemployment will almost certainly remain elevated.

‘Lighten Up’

Powell’s more cautious assessment, and his overall tone at the press conference brought criticism from White House economic adviser Larry Kudlow, who took a swipe at Powell for being too dour.

“I do think Mr. Powell could lighten up a little when he has these press offerings,” Kudlow told Fox News Thursday. “You know, a smile now and then, a little bit of optimism, OK.”

While Powell is being nudged by the White House to offer a brighter outlook, the Fed chair will likely do his own nudging this week of Congress, carefully encouraging lawmakers to offer additional fiscal stimulus, a point on which he is much more closely aligned with the president and Treasury Secretary Steven Mnuchin.

Fiscal Fight

He’ll have to remain careful to avoid getting tangled in a partisan debate. Democrats are also pushing for more fiscal action, especially aid for states and cities facing massive budget shortfalls, but many Republicans have balked at raising additional debt and have pointed to the May jobs report as reason to wait.

Powell has repeatedly said Congress may have to do more, but has stopped short of wading into the political fight.

In his press conference, he said more direct fiscal support for businesses “may be needed.” But he also noted that policy-maker forecasts released last week largely didn’t incorporate additional fiscal intervention, before adding, “If there were more fiscal support, you’d see you’d see better results sooner, but that’s a question for Congress.”

James Knightley, chief international economist at ING Financial Markets, said he wouldn’t be surprised if Powell were slightly more forward on the fiscal issue.

“There’s going to be incredibly forceful questioning on this point,” he said. “Should we not see more fiscal support for states that could have a detrimental effect on the economy.”