Jan 14, 2022

Fed’s Williams Says Decision on Rate Increases ‘Approaching’

, Bloomberg News

(Bloomberg) -- Federal Reserve Bank of New York President John Williams said that given current signs of a very strong labor market, the Fed is approaching a decision to begin gradually raising interest rates from near zero.

“The next step in reducing monetary accommodation to the economy will be to gradually bring the target range for the federal funds rate from its current very-low level back to more normal levels,” Williams said Friday in prepared remarks for a virtual event hosted by the Council on Foreign Relations. “Given the clear signs of a very strong labor market, we are approaching a decision to get that process underway.”

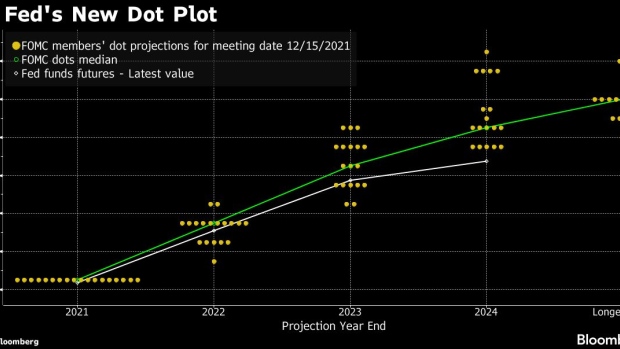

In December, U.S. central bankers forecast that they will raise rates three times this year and sped up the pace at which they are tapering their asset-purchase program -- an effort to tame the fastest inflation in almost four decades. The bond-buying campaign will conclude in mid-March.

Several Fed officials this week said they expect rate hikes to begin at their March 15-16 meeting and that the central bank may have to raise as many as four or even five times this year to get inflation under control.

Williams didn’t give a specific timeline for when the Fed will begin raising rates, noting that the “timing of such decisions will be based on a careful consideration of a wide range of data and information, with a clear eye on our maximum employment and price stability goals.”

The omicron variant of the coronavirus could slow economic growth in the next few months, intensifying labor-supply challenges and supply-chain bottlenecks, Williams said. But once the omicron wave subsides, “the economy should return to a solid growth trajectory and these supply constraints on the economy should ebb over time.”

©2022 Bloomberg L.P.