Mar 31, 2023

Fed’s Williams Says Policy Will be Driven by Data Amid Uncertainty

, Bloomberg News

(Bloomberg) -- Federal Reserve officials said they are keeping a close eye on the effects of recent banking turmoil on the economic outlook as they weigh how much further to raise interest rates.

The comments Friday from New York Fed President John Williams and Fed Governor Lisa Cook also echoed remarks from three regional Fed presidents this week that policymakers will keep up their efforts to bring down inflation, which remains far above their goal.

“The economic outlook is uncertain, and our policy decisions will be driven by the data and the achievement of our maximum employment and price stability mandates,” Williams said Friday during an event organized by Housatonic Community College in Bridgeport, Connecticut.

Williams said it’s not yet clear how much the strains in the bank sector will affect credit conditions, and policymakers will rely on the data to guide their future policy decisions.

Fed officials raised interest rates by a quarter percentage point last week, continuing their yearlong fight to cool price pressures despite recent turbulence in the banking sector.

The move lifted their policy benchmark to a 4.75% to 5% target range, from near zero a year earlier. Forecasts released at the same time show the 18 officials expect rates to reach 5.1% by year-end, according to their median projection, implying one more 25 basis-point hike.

Williams said the Fed’s rate moves until now have been mainly removing the support provided to the economy during the recession. “Mostly what we’ve done is brought interest rates to a more normal, slightly restrictive stance,” he said during the question and answer session after the speech.

Cook said recent banking turmoil would present a headwind to economic growth this year and that further interest-rate hikes would depend on the strength of incoming data.

“I am weighing the implications of stronger momentum in the economy against potential headwinds from recent developments,” she said to the Midwest Economics Association meeting in Cleveland. “If tighter financing conditions restrain the economy, the appropriate path of the federal funds rate may be lower than it would be in their absence.”

Tightening Credit

The Fed’s latest rate increase came after the US government stepped in to guarantee deposits at two failed firms and after the Fed introduced a new emergency-lending program to support other banks. The Fed also worked to boost international access to dollars by enhancing swap lines with its key central bank counterparts.

Williams said “stresses in parts of the banking system are likely to result in a tightening of credit conditions,” which could in turn slow the economy. “The magnitude and duration of these effects, however, is still uncertain,” he said.

The recent strains are also “very different” from the financial crisis of 2008, Williams said. Silicon Valley Bank, which collapsed earlier this month following a run by its depositors, faced a unique set of circumstances, he added.

The banking system is “very resilient” and “strongly capitalized,” he said during a question-and-answer session.

Cook also said she was closely watching banking developments, which could restrain credit to small businesses, while policy makers remain strongly committed to fighting inflation that she said has come in worse than expected this year.

“We will do what it takes to bring inflation back to our 2% target over time,” she said.

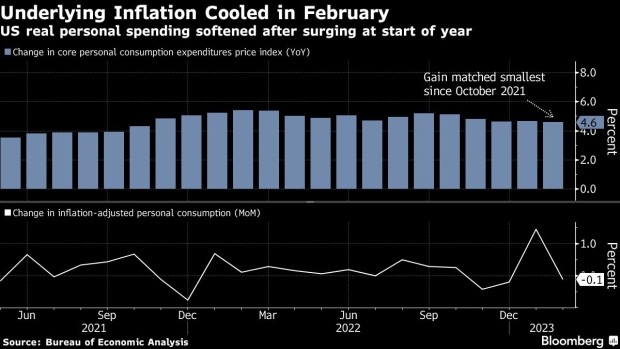

Data released earlier Friday showed the Fed’s preferred inflation gauge rising 5% in February from the previous year, slightly less than economists had forecast.

Williams said he sees inflation dropping to about 3.25% this year before moving closer to the Fed’s 2% target in the next two years. He expects real GDP to grow modestly this year and for the labor market to soften, with the unemployment rate rising to about 4.5% over the next year.

Boston Fed President Susan Collins said Friday morning during an interview with Bloomberg TV that the Fed has more work to do to bring inflation down and that officials will need to watch data closely to assess how much the banking turmoil is affecting access to credit.

Williams said he will be paying close attention to evolving credit conditions, and their effect on the outlook for growth, employment and inflation.

(Updates with comments from Cook before and after ‘Tightening Credit’ subheadline.)

©2023 Bloomberg L.P.