Mar 25, 2021

Fed says dividend restrictions to end June 30 for most banks

, Bloomberg News

Market closely watching Fed’s dovish stand and likelihood of tax hikes: CIBC's Tal

Large U.S. banks that clear the next round of stress tests with sufficient capital will be allowed to resume dividend increases at the end of June, the Federal Reserve said, signaling an end to pandemic-era restrictions that dragged on financial stocks last year.

Any continuing limits on stock buybacks also will be lifted for lenders that perform well in the exams, the Fed said in a statement Thursday. That means “most firms” will be free of the emergency curbs on payouts to shareholders, it said.

“The banking system continues to be a source of strength and returning to our normal framework after this year’s stress test will preserve that strength,” Fed Vice Chairman for Supervision Randal Quarles said in the statement. The board’s decision was approved unanimously.

Major banks including the nation’s four largest -- JPMorgan Chase & Co., Bank of America Corp., Citigroup Inc. and Wells Fargo & Co. -- ticked higher in after-hours trading as of 6 p.m. in New York.

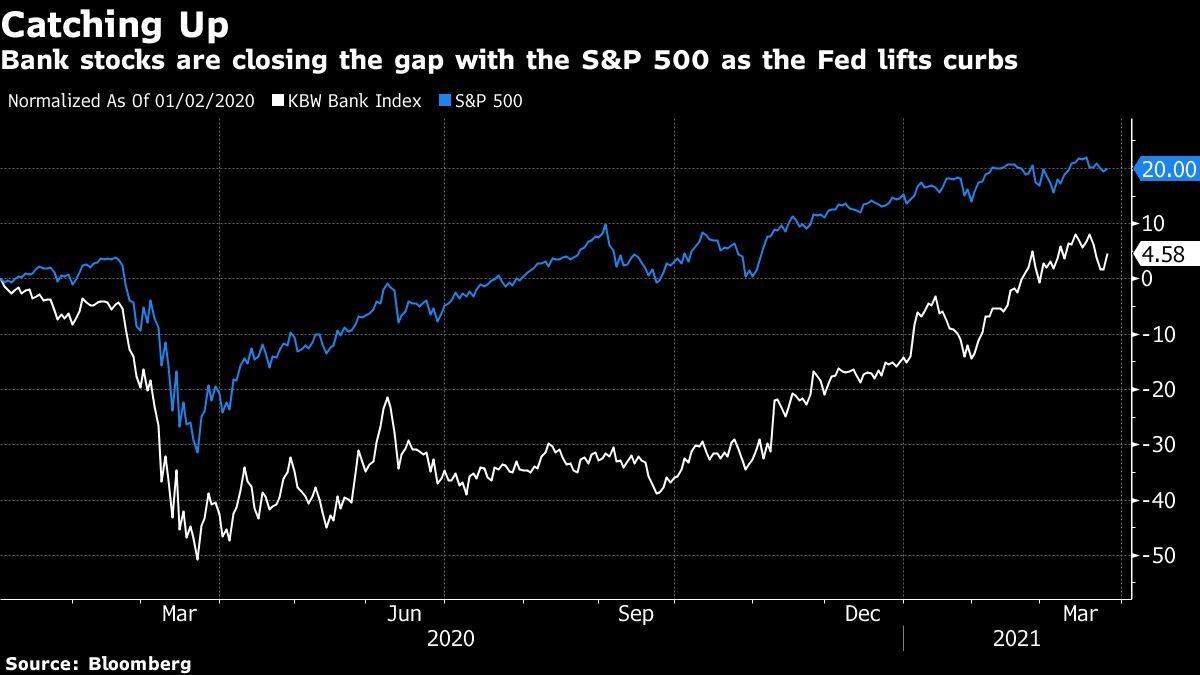

The Fed barred big banks from raising dividends last June, forcing them to stockpile capital and maintain firepower for lending as the pandemic took a widening toll on the economy. But that eroded returns while highlighting concerns about the potential for a tidal wave of loan defaults that never materialized. Shares across the industry have been closing the gap with the broader market in recent months as the regulator eased off.

The Fed relaxed a restriction on buybacks in December, allowing big banks to resume purchases.

And in another step toward normality last week, the central bank ended a significant break on capital requirements for Wall Street firms, citing about $200 billion in excess capital at the largest lenders. Analysts took it as a sign that the Fed would soon end its restriction on dividends.

An additional round of stress tests conducted in December because of the pandemic showed all of the largest U.S. banks -- also including Goldman Sachs Group Inc. and Morgan Stanley -- met minimum thresholds. Still, Governor Lael Brainard cautioned that some of the lenders came near the edge under the agency’s hypothetical disaster scenario.

Spokespeople for the six banking giants declined to comment or didn’t immediately respond to requests for comment on the Fed’s announcement Thursday.

The companies are widely expected to clear the same marks in June, letting them return to business as usual distributing capital to shareholders -- a practice that’s drawn the ire of Democratic lawmakers critical of past taxpayer-funded bailouts of the industry.

The Fed’s unanimity bodes well for the financial industry, Cowen & Co. analyst Jaret Seiberg wrote in a note.

“This does not mean the decision will go over well on Capitol Hill,” he wrote. “There will be noise. None of that will result in the Federal Reserve changing course.”