Sep 18, 2019

Fed Skips Over Repo as Doves and Hawks Squabble

, Bloomberg News

(Bloomberg Opinion) -- The Federal Reserve’s interest-rate decision on Wednesday was never going to be easy for Chair Jerome Powell.

He and his colleagues had to reach consensus on how to weigh the U.S.-China trade war against a still-solid labor market and American consumer, not to mention signs of a pickup in inflation. They had to contend with whipsawing bond markets, which were pricing in almost three quarter-point rate cuts for 2019 at the start of September but expected fewer than two ahead of the Federal Open Market Committee’s meeting.

Then came repo madness.

Incredibly, and seemingly out of nowhere, the usually tranquil plumbing of the financial system went haywire. And that might be putting it mildly. The rate for general collateral repurchase agreements in the more than $2 trillion repo market reached a record 10% on Tuesday. The effective fed funds rate broke policy makers’ 2.25% cap on Wednesday. This isn’t supposed to happen.

And yet, this week’s developments didn’t even merit a mention in the FOMC statement. Some analysts, like Matthew Hornbach at Morgan Stanley, said it was likely the Fed would announce permanent open market operations. Jeffrey Gundlach, chief investment officer of DoubleLine Capital, said in a webcast on Tuesday that the central bank might expand its balance sheet as a way of “baby stepping” to more quantitative easing.

This doesn’t mean the Fed doesn’t care, or that it won’t ultimately adopt those measures. Most likely, it just didn’t have enough time to react in a big way.

Policy makers did drop the interest rate on excess reserves, or IOER, by 30 basis points to regain control over short-term rates. The IOER rate had been set at the upper bound of the fed funds range until June 2018, when the Fed raised it by only 20 basis points. It’s now down to 1.8%, while the 25-basis-point cut to the fed funds rate sets the range at 1.75% to 2%. Basically, if stress in funding markets keeps pushing short-term rates higher, the sharper cut in IOER makes it somewhat less likely that the fed funds rate will breach the upper bound.

Powell eventually addressed repo markets head-on, largely at the prodding of reporters:

“Going forward, we’re going to be very closely monitoring market developments and assessing their implications for the appropriate level of reserves.

And we’re going to be assessing the question of when it will be appropriate to resume the organic growth of our balance sheet. And I’m sure we’ll be revisiting that question during this inter-meeting period and certainly at our next meeting.

We’ve always said that the level is uncertain. That’s something we’ve tried to be very clear about. We’ve invested lots of time talking to many of the large holders of reserves to assess what they say is their demand for reserves…

But yes, there’s real uncertainty, and it is certainly possible that we’ll need to resume the organic growth of the balance sheet earlier than we thought. That’s always been a possibility.”

The key word he seemed to stress was “organic.” That’s because any hint of expanding the balance sheet can be misconstrued as a resumption of post-crisis quantitative easing. However, it would be a mistake to consider it the same as QE. Hornbach explained it eloquently on Bloomberg TV before the Fed’s decision:

“Quantitative easing, the purpose of that is to expand reserves in the system from the status quo of the reserves that are needed to keep liquidity and the fed funds target within that range. When you start losing control of the target rate, you need to increase reserves in the system, but that’s not necessarily quantitative easing as we know it in a traditional sense. They’re not trying to ease monetary policy, they’re trying to get better control over that short-term interest rate.”

That’s the type of nuance that can get lost on investors if the Fed, and those who write about it, aren’t careful.

In fact, Wednesday’s interest-rate decision could be seen as something of a “hawkish cut.” Policy makers’ “dot plot” signaled sharp divisions among policy makers, as Powell predicted, with the median estimates calling for no more rate cuts through 2020. It then shows one quarter-point hike in 2021 and another in 2022, albeit with many different estimates.

Five of them appeared to indicate they didn’t agree with the decision to reduce rates on Wednesday. That almost certainly includes Esther George and Eric Rosengren, who openly dissented. James Bullard dissented as well, but because he favored a 50-basis-point cut.

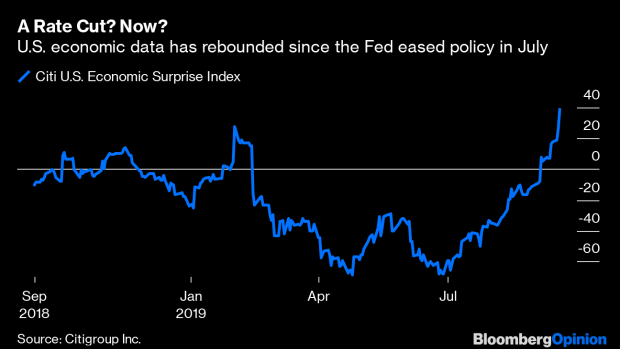

On any other Fed day, this squabble between the hawks and doves would take center stage. After all, it’s the first decision with three dissents since 2016 and the first with dissents in both directions since mid-2013. Citigroup Inc.’s Economic Surprise Index, for one, suggests those who opposed easing policy have a point: It’s at the highest level since April 2018.

President Donald Trump, to no one’s surprise, sides with Bullard. He tweeted almost immediately after the Fed decision that Powell and the central bank have no “guts.”

The real test of the Fed’s mettle will be if the short-term rate markets continue to exhibit stress. The New York Fed has been the subject of market ridicule for having to cancel its first overnight repo operation in a decade on Tuesday because of technical difficulties and for being late to do so in the first place. Powell said that funding markets “have no implications for the economy or the stance of monetary policy.” That’s true — but only until they do.

To contact the author of this story: Brian Chappatta at bchappatta1@bloomberg.net

To contact the editor responsible for this story: Daniel Niemi at dniemi1@bloomberg.net

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Brian Chappatta is a Bloomberg Opinion columnist covering debt markets. He previously covered bonds for Bloomberg News. He is also a CFA charterholder.

©2019 Bloomberg L.P.