Mar 10, 2023

Fed Swaps Fully Price in Quarter-Point Rate Cut by Year-End

, Bloomberg News

(Bloomberg) -- Derivative traders lost no time re-instating bets that the Federal Reserve will cut interest rates before the year is out.

As recently as Wednesday, a half-point rate hike this month was viewed as likelier than another quarter-point move and a rate cut later this year was counted out. But with rising borrowing costs subsequently taking the blame for the year’s first bank failure, pricing of swaps linked to Fed meetings shifted Friday to levels suggesting the central bank’s policy rate will peak at around 5.3% in June and end the year below 5%. It’s in a range of 4.5% to 4.75% now.

The expected peak is now down sharply from the 5.7% that was priced in earlier this week after Fed Chair Jerome Powell in Congressional testimony seemed to open the door to a re-acceleration in the pace of rate hikes. That revision downward came as the Labor Department’s employment report showed some cooling in the job market and the collapse of Silicon Valley Bank in California raised concerns about the financial health of lenders.

Fed officials “do have to pay attention to this because something is apparently starting to break, and they have raised rates a lot,” said Tony Farren, managing director at Mischler Financial Group Inc. “The reaction to Powell was way too aggressive.”

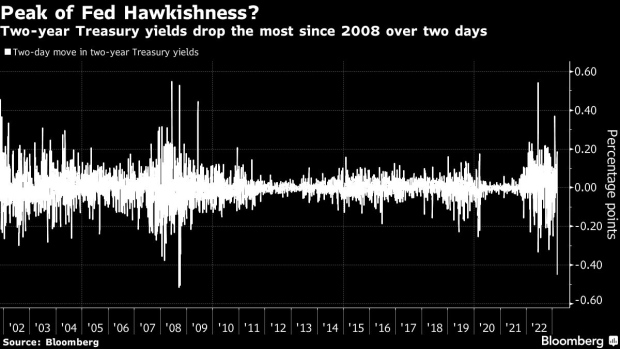

Meanwhile, the two-year Treasury yield on Friday was on track for its second-straight drop of more than 20 basis points. It fell as much as 29 basis points to 4.58%. Its 48-basis-point drop over two days is bigger than any since 2008.

The Friday move capped a volatile week for the bond market. In the fallout from Powell’s comments, the two-year yield climbed to 5.08% on Wednesday, the highest level since 2007, setting the stage for a snap-back.

The spark for that occurred Thursday, when the Silicon Valley lender blamed higher interest rates as its failed to raise capital, turning it Friday into the first federally insured institution to fail this year. To varying degrees, shareholders punished the entire banking sector, driving financial companies in the S&P 500 are down over 8% as a group on the week, leading the benchmark to a 4.5% drop.

“It appears that the fear of a hard landing is starting to be built back into rate expectations,” said Mark Dowding, chief investment officer at RBC BlueBay Asset Management. “Bank stress may be seen as a sign that monetary policy is working to tighten conditions, albeit with a lag.”

Longer-dated Treasury yields also declined Friday, aided by the mixed February employment data that was seen as lessening the need for the Fed to re-accelerate. The Labor Department report showed bigger-than-expected job growth, but wages increased less than forecast and the unemployment rate edged up.

Still, following the report Barclays economists predicted that the Fed will raise borrowing costs by 50 basis points at the March 22 policy meeting, up from the previous call for a quarter percentage point move. The job report confirmed “a stronger underlying growth picture than in early February,” economists led by Marc Giannoni wrote. They acknowledging that it was a close call in the wake of the Silicon Valley Bank debacle.

Swap traders, for their part, have tempered their expectations for the Fed. They now see a 25-basis point hike as more likely than half-point move, which was given odds as high as about 75% earlier in the week.

In addition to the banking sector, traders will watch the consumer-price inflation report next Tuesday closely watched for clues on Fed’s policy trajectory.

James Athey, investment director at Abrdn, said the Silicon Valley Bank saga showed that the most aggressive Fed tightening since the 1980s is starting to wreak havoc across leveraged firms, which may eventually force the Fed to change course.

“I have always thought that cuts would come quicker than the Fed or the market expects,” said Athey. “I suspect this is the beginning, not the end of the stressed corporates story. With CPI still to come on Tuesday, the market is going remain on edge.”

--With assistance from Elizabeth Stanton.

(Updates yield levels.)

©2023 Bloomberg L.P.