Jun 19, 2018

FedEx profit surges on boom in demand for e-commerce deliveries

, Bloomberg News

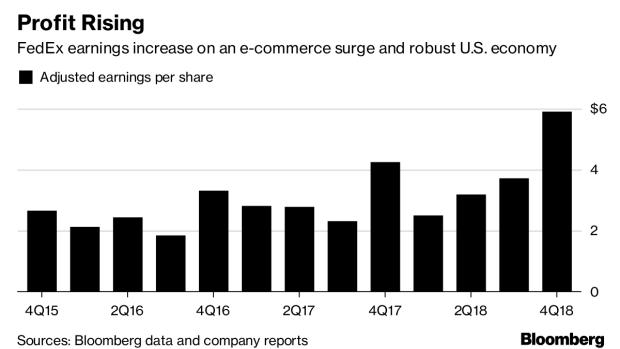

FedEx Corp. (FDX.N) reported fiscal fourth quarter profit that beat expectations as an e-commerce boom boosts package deliveries and a manufacturing rebound drives growing demand in its freight-hauling business.

FedEx and other package delivery companies have benefited from online shopping that surged 17 per cent in 2017 as consumers increasingly opted for the convenience of having goods shipped directly to their homes. FedEx has invested heavily to keep up with the flood of demand by automating its operations, and those investments are beginning to pay off.

For its fiscal fourth quarter, FedEx reported adjusted earnings per share of US$5.91. Analysts had predicted US$5.69. Revenue was US$17.3 billion, compared with analysts’ expectations of US$17.2 billion.

The company forecast earnings of US$17 to US$17.60 a share for the fiscal year through next May, excluding pension adjustments and costs from the integration of TNT Express. The midpoint of the forecast is lower than the average US$17.48 estimate of analysts surveyed by Bloomberg, but would represent a 13 per cent gain on adjusted earnings for the year that ended May 31, Memphis, Tennessee-based FedEx said in a statement Tuesday.

Industrial freight is also rebounding, with the added bonus of rising cargo prices as trucking companies struggle to find enough drivers. Rates for less-than-truckload business, the category where FedEx competes, are expected to rise 13 per cent this year, according to freight forecaster FTR Transportation Intelligence.

FedEx has risen 3.5 per cent this year, compared to a 3.3 per cent rise in the S&P. Shares were little changed at US$258.50 after the close of regular trading in New York.