Jun 14, 2022

FedEx surges most since 1986 on activist-backed overhaul plan

, Bloomberg News

Lorne Steinberg discusses FedEx

FedEx Corp.’s shares soared the most in almost 36 years after the courier hiked its dividend and announced board changes in coordination with activist investor D.E. Shaw & Co., a bold shakeup just two weeks into the tenure of new Chief Executive Officer Raj Subramaniam.

The quarterly dividend will jump 53 per cent to US$1.15 per share, the Memphis, Tennessee-based company said Tuesday in a statement. That’s well above the 87-cent prediction by Bloomberg analytics. FedEx also said it would cut capital spending and rework its executive compensation program.

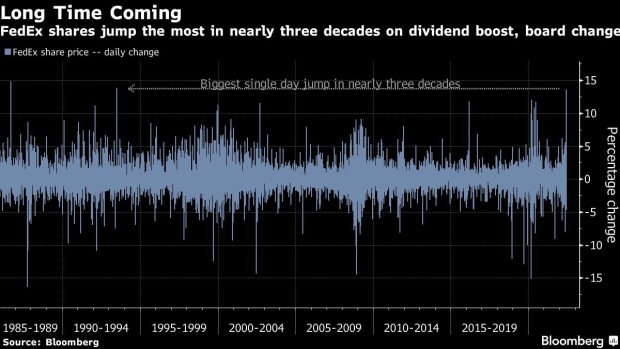

The shares surged 14 per cent to US$229.95 in New York, the biggest one-day gain since September 1986. The stock has declined 11 per cent this year, better than the S&P 500’s slide.

The higher-than-expected dividend increase and reduction in capital spending will be accompanied by the addition of Amy Lane and Jim Vena as independent directors effective immediately, with a third new director to be named at a later date and agreed upon by FedEx and D.E. Shaw.

“We appreciate the collaboration with the D. E. Shaw group, a long-time FedEx stockholder, with whom we have maintained an ongoing and constructive dialogue in reaching this agreement,” Subramaniam said in the statement.

“Investors have been speculating about an activist at FDX for years, without one materializing,” Jack Atkins, an analyst with Stephens with an “overweight” rating on the stock, wrote in a note to clients. “Now, with a new leadership team and fresh voices on the board (including a proven operator like Mr. Vena), we are hopeful that a new day is dawning.”

UNDER NEW MANAGEMENT

The moves indicate that Subramaniam, who took over as CEO from founder Fred Smith on June 1, may be more open to addressing investor concerns as FedEx struggles to boost profit margins and has trailed the performance of its larger rival, United Parcel Service Inc. Smith, who started FedEx operations in 1973 with a handful of private jets converted to freighters, remained as chairman of the board. He is FedEx’s single largest stockholder with 7.5 per cent of outstanding shares.

FedEx’s annual operating profit margins haven’t topped seven per cent since 2017 and lately the company has struggled to hire enough workers at its sorting hubs, hurting its on-time delivery performance. UPS, which hired former Home Depot Inc. CFO Carol Tome as CEO in June 2020, increased its profit margins to 13.2 per cent last year, up from 9.1 per cent in 2020, and has maintained its on-time service.

The structural pressures on FedEx “are intensifying” as more retailers ship directly from the store, the US Postal Service expands operations and Amazon.com Inc. looks to extend its logistics service to also pick up packages, which will put the e-commerce giant in direct competition with FedEx and UPS, said Ravi Shanker, an analyst with Morgan Stanley in a note to clients.

“While the market may welcome today’s ‘shareholder friendly’ actions, in our view none of this addresses the real pressures facing the business,” Shanker, who has a rating of “equal weight” on the stock, wrote in the note.

FedEx is planning to hold its first investor day meeting in a decade at the end of this month and more changes are likely to be announced. Still, Smith has a big say in how to run the company and he appointed his son, Richard Smith, as chief of the company’s largest unit FedEx Express in March before announcing that Subramaniam would be his successor.

“We are surprised that we have seen a prolonged slow drip of meaningful news items (CEO transition, today’s announcements) well before the marquee event,” Shanker said in the note. Management “will need to have more aces in hand to meet expectations at the event.”

COMBINE UNITS

Some investors have clamored for FedEx to combine its Ground and Express networks to improve efficiency and emulate UPS’s one network. That may be difficult because the Ground business is operated by independent contractors, a major structural difference from the Express business that owns aircraft and vehicles and has employees and pilots directly on payroll.

As part of the agreement with D.E. Shaw, the company made several changes to board committees. Separately, FedEx also tied executive pay more to its total shareholder return.

D.E. Shaw owned about one million shares as of March 31, making it FedEx’s 35th largest holder, according to Bloomberg data. With US$60 billion in assets under management, D.E. Shaw has pushed for changes at several companies in the past, including Exxon Mobil Corp., Bunge Ltd., and Lowe’s Cos., among others.

Vena is a former railroad executive who worked at Canadian National Railway Co. and recently helped Union Pacific Corp. improve efficiency. Lane is a former Merrill Lynch & Co. banker who also sits on the boards of NextEra Energy Inc. and TJX Companies Inc.