Jul 14, 2022

Fertilizer Crisis Shrinking Crops in Eastern Europe Could Worsen

, Bloomberg News

(Bloomberg) -- Like in many parts of the world, harvests underway in eastern Europe have suffered from a fertilizer crisis -- and things could get worse.

That’s according to Hungarian producer Nitrogenmuvek Zrt, which sees grain yields falling 15% to 20% this year in a region that includes major European exporters Romania and Poland. Farmers have cut nutrient usage due to high prices and supply issues, at a time when dryness has also threatened crops.

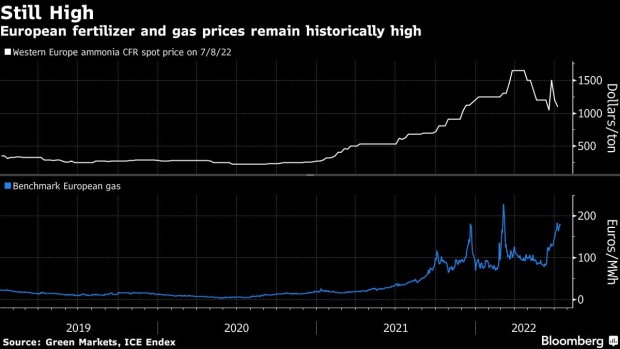

Fertilizers have become more expensive as a rally in natural gas -- a crucial feedstock -- raised costs and cut output. Sanctions on Belarusian potash and China’s move to rein in shipments have added to the crunch. That in turn is threatening global crop supplies that have been strained by the war in the breadbasket nation of Ukraine.

There may not be much relief any time soon. Worries linger about a prolonged gas crunch in Europe, which would be bad news for nutrient production.

“The winter is going to be extreme, everyone in the industry is taking it for granted that there will be no gas supply,” said Zoltan Bige, Nitrogenmuvek’s chief strategy officer. Crop yields could fall further across Europe as the current season will be the first full one affected by the war, he said.

Another problem is that nitrogen-based fertilizers, the type favored in Europe, can’t be replaced with urea-based ones produced elsewhere, he said.

Hungary’s government last week said the country’s wheat crop may fall below 4 million tons, down about a third from the five-year average. If European farmers keep scrimping on fertilizers, that will threaten crops due to be planted in autumn for collection in 2023.

High gas prices pose a “critical” threat to the European fertilizer industry, industry group Fertilizers Europe said earlier this month. Nitrogenmuvek itself could use up its cash buffer in the next month and half.

“We will not have a reserve for a possible negative scenario such as a further increase in gas prices or potential unplanned maintenance,” Bige said.

Nitrogenmuvek is currently running at full capacity of around 4,000 tons a day, despite recent gains in gas prices, as it tries to make up for shortfalls caused by shutdowns earlier this year. Output this year will probably fall 10% even if the situation stays as it is.

The big question is how gas costs and supplies will impact fertilizer production later in the year.

“With gas prices as they have been in recent weeks, it would not even be worth producing,” Bige said.

©2022 Bloomberg L.P.