May 21, 2018

Fifth Third Slumps After $4.7 Billion Deal to Buy MB Financial

, Bloomberg News

(Bloomberg) -- Fifth Third Bancorp slumped the most in almost two years after saying it would buy Chicago’s MB Financial Inc. for $4.7 billion to defend its Midwest turf.

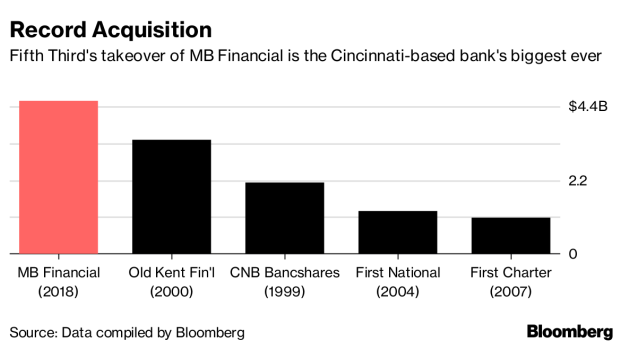

The transaction price, the most Fifth Third has ever paid for an acquisition, is 24 percent higher than MB Financial’s closing price on May 18. The combination will make Fifth Third the second-largest bank in Chicago by deposits, behind JPMorgan Chase & Co.

“They’re giving away more upfront than they’re getting in the short term,” Chris Marinac, director of research for FIG Partners, said in a telephone interview. “Fifth Third’s paying a premium in a pretty big way.”

Fifth Third, which gains MB Financial’s roughly $20 billion of assets in the region, said in a statement Monday that the acquisition means it can boost financial targets.

Chicago has the second-highest number of middle-market firms in the country behind New York City, making it an attractive market for commercial banking, Fifth Third Chief Executive Officer Greg Carmichael said on a conference call. The bank has long focused on large corporate customers, he said, and buying MB Financial will give it greater access to smaller commercial clients.

“This is not a company that is spread out to weaker markets across different states,” Tayfun Tuzun, chief financial officer at Fifth Third, said on the call. “This is one single market, a very important market for us, and we’ll hit the ground running day one. And what we paid for the company is everything related to what this company brings to us.”

Operating Earnings

The acquisition will generate an internal rate of return of almost 19 percent and be accretive to operating earnings in the first year, according to Carmichael. It will probably reduce Fifth Third’s regulatory common equity Tier 1 ratio by about 45 basis points, the bank said.

“There were no other potential partners of the same caliber as MB Financial in the Chicago market,” the CEO said in the statement.

Mitch Feiger, MB Financial’s CEO, acknowledged on the conference call that the bidding process for his firm was competitive, declining to say more. He said the two companies had been in dialogue about a transaction for a “long period of time.” Feiger will be Fifth Third’s chairman and CEO for the Chicago region.

The Chicago market has become highly fragmented in recent years and has drawn interest from Canadian banks looking to expand in the U.S., said Nathan Race, an analyst at Piper Jaffray & Co.

Fifth Third fell 7.4 percent to $31.08 at 10:34 a.m. in New York, the biggest drop since June 2016. MB Financial rose 14 percent to $49.63.

MB Financial shareholders will receive a total of about $54.20 for each of their shares, consisting of 1.45 shares of Fifth Third common stock and $5.54 in cash, the companies said. Two members of MB Financial’s board will join Fifth Third’s board. About 90 percent of the deal will be paid for in stock and the rest in cash.

To contact the reporter on this story: Jenny Surane in New York at jsurane4@bloomberg.net

To contact the editors responsible for this story: Michael J. Moore at mmoore55@bloomberg.net, Steve Dickson, Alan Mirabella

©2018 Bloomberg L.P.