Oct 11, 2022

'Fire sale' risk in bonds pushes BOE to step up measures

, Bloomberg News

Standard Chartered Remains 'Quite Bearish' on British Pound

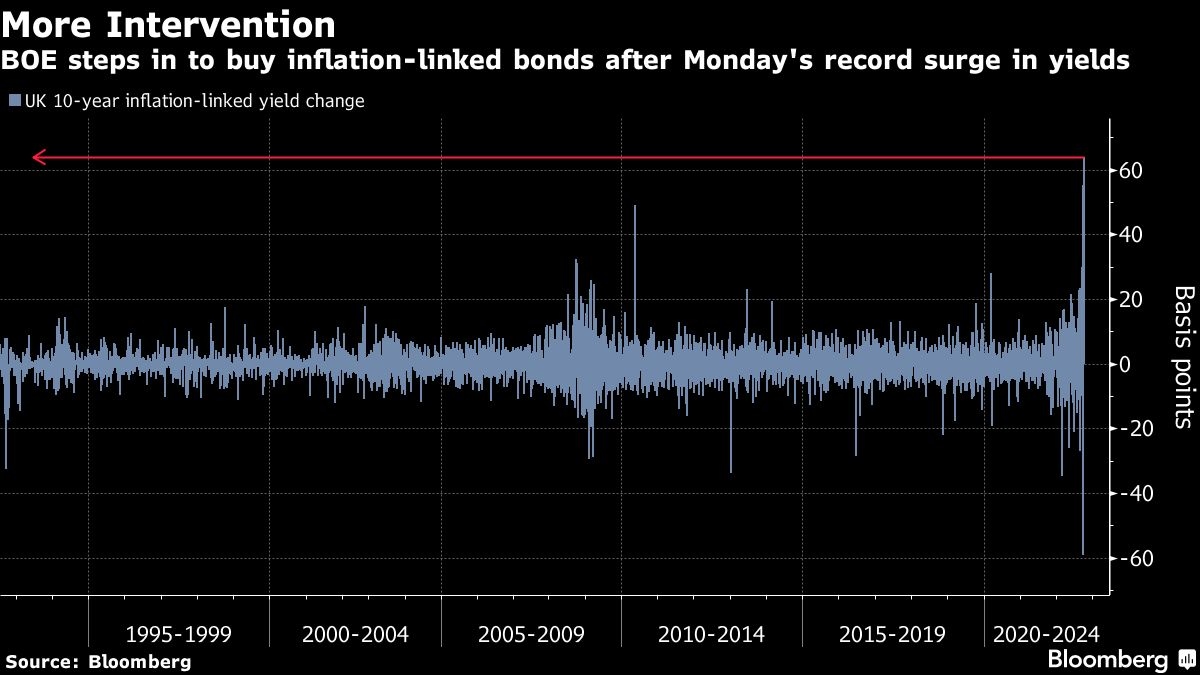

The Bank of England is expanding the scope of its bond purchases to include inflation-linked debt in an effort to avert what it called a “fire sale” that threatens financial stability.

It’s the second time this week the central bank has added to its arsenal of tools aimed at curbing market turbulence. The move, coming on the heels of Monday’s record selloff in inflation-linked debt, had the immediate effect of bringing some calm to the market.

The yield on 10-year inflation-linked securities dropped as much as 12 basis points after the BOE announcement, while a sale of £900 million of inflation-linked 30-year bonds from the government then saw strong investor appetite. Conventional debt initially also rallied, before paring gains, showing sentiment is still fragile.

“The BOE is clearly playing gilt selloff whack-a-mole,” said Antoine Bouvet, senior rates strategist at ING Groep NV. “The policy of consistently acting at the last minute without putting a more credible long-term plan in place is unnerving for markets.”

Ever since Chancellor of the Exchequer Kwasi Kwarteng announced a vast package of unfunded tax cuts, UK markets have been gripped by turmoil and the threat of collapse of a key part of the pensions industry. The funds are a major owner of inflation-linked debt and have been selling UK assets in the wake of collateral calls that triggered the spiral of bond-market losses.

While the BOE has stressed that it’ll stop a disorderly market from threatening the UK’s financial stability, investors warn the repeated interventions are coming at a cost of the central bank’s credibility. In the view of strategists, there’s little that the central bank can do to repair investor confidence shattered by government U-turns and risky policy.

“The root cause of the problem is that investor confidence in UK Plc has been shaken and the BOE is attempting to mask the symptoms of that given it can do nothing to address the cause,” said Richard McGuire, head of rates strategy at Rabobank.

The decision to buy index-linked securities is unusual for the central bank, which only bought conventional gilts during previous rounds of quantitative easing. The BOE said on Tuesday that it will allocate up to £5 billion (US$5.51 billion) to conventional gilts and £5 billion to index-linked gilts at each remaining buyback.

That expands the scope of a bond-buying program, initially of long-maturity gilts. The emergency measure was intended to buy time for liability-driven investment funds -- at the heart of the gilt selloff prior to the BOE’s intervention -- to protect themselves from further spikes in yields. The central bank noted it had made “substantial progress.”

“Dysfunction in this market, and the prospect of self-reinforcing ‘fire sale’ dynamics pose a material risk to UK financial stability,” the central bank said in a statement.

The BOE measures today will support an “orderly” end to the bank’s purchase program, Prime Minister Liz Truss’s spokesman, Max Blain, told reporters in London on Tuesday. He said Truss’s cabinet didn’t discuss the market reaction to the bank’s measures at its regular weekly meeting.

SAFETY NET

Some pension funds said the BOE’s bond-buying interventions should be extended until the end of the month and even beyond, according to a statement from an industry body. Other funds suggested additional measures be put in place to manage market volatility if purchases are ended.

The BOE has already added to its tools to help protect against broader financial turmoil. On Monday, the BOE expanded the amount of gilts it could buy in a given operation, and launched the Temporary Expanded Collateral Repo Facility designed to help banks ease liquidity pressures on LDI clients.

The BOE wants to be a safety net for the market, so it has only purchased a small fraction of the total amount proposed. Since Sept. 28, the central bank has bought £5.43 billion of longer-dated gilts out of a maximum of £50 billion.

The question remains what further steps the BOE may need to do to soothe the market, such as further postponing the start of the active selling of gilts. Active sales are currently slated to start at the end of the month as part of BOE’s plan to unwind its swollen balance sheet.

“It’s not a time for large monetary tightening, so I think QT is over,” said Hank Calenti, fixed income strategist at SMBC Nikko Capital Markets Ltd.

What Bloomberg Economics Says...

“The Bank of England is having a difficult time calming markets. It’s latest intervention -- an offer to purchase index linked bonds -- is designed to counter “self-reinforcing ‘fire sale’ dynamics.” We think it’s more likely than not that the central bank will have to commit to intervening in the bond market where necessary beyond Oct. 14, the current end date for the purchases.”

-- Dan Hanson and Jamie Rush, Bloomberg Economics.

Separately, the central bank also paused the sale of corporate bonds it accumulated during quantitative easing and confirmed that gilt purchase operations would only continue until Oct. 14.

“These additional operations will act as a further backstop to restore orderly market conditions by temporarily absorbing selling of index-linked gilts in excess of market intermediation capacity,” the BOE said.