Sep 7, 2021

Firms Hoard Cash as Credit Markets Watch ECB’s Next Move

, Bloomberg News

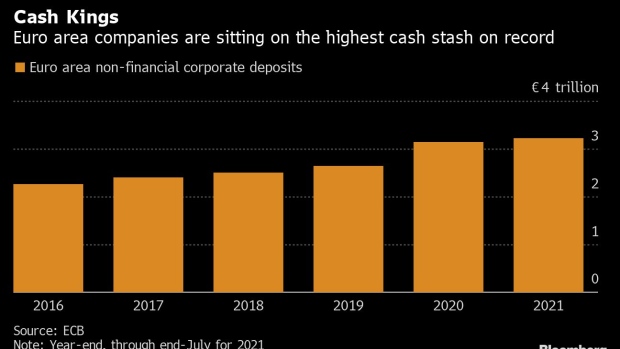

(Bloomberg) -- Europe Inc. has never had more cash in the bank, boosting investor confidence that corporate debt markets can weather rainy days caused by the spread of Covid-19 variants or the scaling back of central bank stimulus.

Deposits of non-financial companies in the euro area ended July at a record high of 3.2 trillion euros ($3.8 trillion), based on data from the European Central Bank. That’s about 600 billion euros more than the amount parked with lenders at the start of the coronavirus pandemic last year.

The size of the cash cushion is a big reason for the calm seen in high-grade credit markets, even as traders become increasingly watchful for signs for when ECB policy makers, who meet on Thursday, will start to wind down stimulus.

The reason is that big cash balances can help companies withstand periodic paroxysms, such as when credit markets froze in 2020, while also providing insurance against excessive borrowing. Spreads continue to hover near 84 basis points, as they’ve done since mid-April, based on Bloomberg indexes.

Firms “could be more aggressive but, at the moment, they prefer to be prudent,” said Philipp Burckhardt, a fixed income analyst and portfolio manager at Lombard Odier Investment Managers, which oversees close to 70 billion Swiss francs ($76.5 billion) “Spreads are reflective of this environment: the macro backdrop is beneficial and the micro side is resilient.”

Meanwhile, buyers of corporate bonds are also flush with cash after flows into investment-grade funds picked up in recent weeks.

Strong Inflows

Retail investor money streaming into Europe-domiciled high-grade funds exceeds $50 billion so far this year, based on EPFR Global data compiled by Bank of America strategists. The latest data published last week show “strong inflows” to high-grade credit funds that can be attributed to rising uncertainty over the delta variant of the coronavirus, strategists led by Ioannis Angelakis wrote in a note to clients.

“There have been some moments recently where spreads tried to move wider but it hasn’t taken long for credit managers to put what cash they have to work - and credit managers do have an abundance of cash,” said Tom Moulds, a portfolio manager at BlueBay Asset Management, which oversees more than $75 billion. “It can be counter-intuitive and a head-scratcher but the market remains underpinned.”

Still, risks remain with the withdrawal of central bank stimulus looming large among them. Scrutiny of this week’s ECB meeting has increased with inflation picking up and policy makers saying the price rises could lead stimulus to be scaled back. Even so, it would take something big to move the market.

“It’s hard to get too concerned for the next few months,” said BlueBay’s Moulds. “There are plenty of catalysts to upset the credit market but all are relatively low-likelihood.”

©2021 Bloomberg L.P.