Jan 14, 2022

First Lumber. Then Tin. Now the Newest Squeeze Is in Nickel

, Bloomberg News

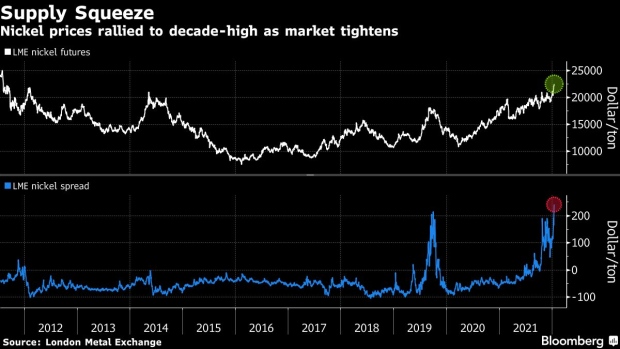

(Bloomberg) -- Nickel rallied to the highest in more than a decade as dwindling exchange inventories leave traders bracing for a historic supply squeeze.

In a sign that traders are scrambling for spot supplies, cash contracts traded at the widest premium to three-month futures since 2007 on the London Metal Exchange on Thursday. And with Shanghai Futures Exchange stockpiles near a record low, nickel’s tight supply dynamics have made it the star performer during a broad rally in base metals markets this month, with prices up 9.1%.

Nickel climbed as much as 3.4% to $22,935 a ton on Friday, at the highest since August 2011. Investor interest is growing amid booming use in electric-vehicle batteries, providing a further boost as metals rally on the back of deteriorating supply. Prices have also been supported after Indonesia said it’s considering a plan to impose an export tax on some nickel products.

Even for those who think the nickel market is overheating, the steep backwardation may discourage them from taking bearish bets, as they could be exposed to heavy losses when rolling contracts forward or buying them back.

“If you get a situation where there’s a scramble for supply, you could see some outsized price moves off the back of it,” Colin Hamilton, managing director for commodities research at BMO Capital Markets, said by phone from London. “From that point of view, it’s very difficult to advocate for anyone to take an aggressive short position.”

Zinc and aluminum production has also been hit hard during Europe’s energy crisis, and a fresh spike in regional power prices is bringing supply worries back to the fore across metals markets.

Investors are also parsing data released Friday that showed China’s record-breaking export strength continued into December, pushing the annual trade surplus to a new high. Still, trade growth is expected to be weaker in the new year as demand for work-from-home technology and healthcare equipment slows and consumption shifts toward services as the rest of the world starts to live with Covid.

Nickel was up 2.3% at $22,680 a ton as of 9:52 a.m. on the LME, while other metals traded little changed or slightly higher. Copper was steady at $9,951.50 a ton, after earlier this week closing at the highest since October.

©2022 Bloomberg L.P.