May 8, 2022

First Quantum approves US$1.25B Zambia copper expansion

, Bloomberg News

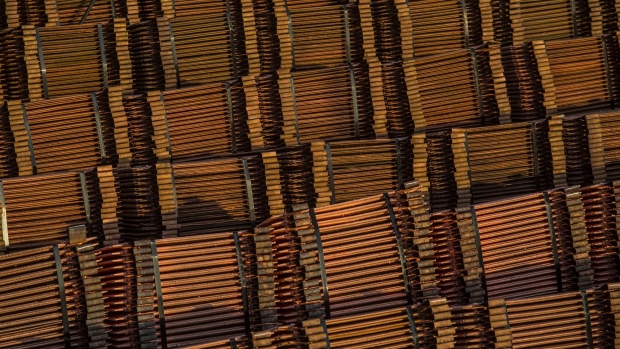

First Quantum Minerals Ltd. approved a US$1.25 billion project to expand its Kansanshi copper mine in Zambia after the new government committed to a more predictable investment climate.

The investment will extend the life of one of Africa’s biggest copper mines until the 2040s and increase copper and gold production by about 25 per cent, the company said in a statement Sunday. First Quantum has also approved the development of a new nickel project, which is expected to cost about US$100 million.

Zambia is seeking to expand output and attract investment by repairing relations with mining companies that were fraught under a previous government. Zambian President Hakainde Hichilema won a landslide victory in elections last year and pledged to boost growth in the country that ranks as one of the world’s biggest copper producers.

Zambia is also seeking to woo investors at a time when the mining industry faces renewed political and social pressure in some other key copper-producing nations.

Zambia’s relationship with foreign mining companies deteriorated under former President Edgar Lungu, whose government took an increasingly aggressive stance with the industry. One key point of dispute was over whether a new mineral royalty would be deductible from other corporate taxes -- a change which became effective in January this year.

First Quantum and the government have also resolved “all points of contention that have been stumbling blocks” to the two projects, including agreement on an outstanding value-added tax receivable sum and a plan for repayment based on offsets against future mining taxes and royalties, the company said.

“The government’s commitment to improve the predictability of the mining fiscal regime also provides the certainty needed to support large capital investments in Zambia,” First Quantum said.