Jul 11, 2017

First rate bump 'hardly a game changer' for Canadian banks: Analyst

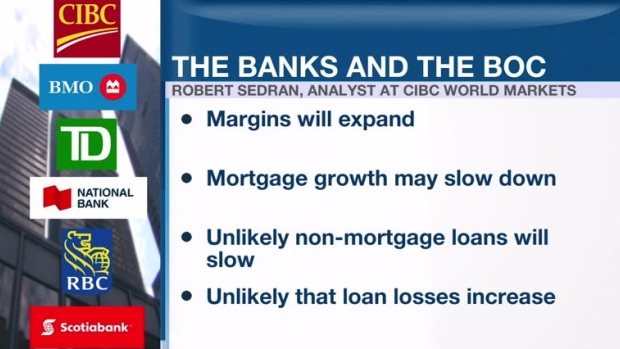

CIBC’s bank analysts aren’t convinced a rate increase will be a game changer for Canada’s Big Six, but they figure it couldn’t hurt. In a research note to clients Tuesday, analysts Robert Sedran, Marco Giurleo and Christopher Bailey wrote the widely-expected increase from the Bank of Canada at Wednesday’s meeting may help around the margins, but materially higher rates would be necessary to see a decent boost to the banks’ bottom lines.

“On margins, hallelujah, rates have stopped declining. There is no question that this provides some relief from margin pressure, but we are not changing estimates at this time,” the analysts wrote.

The CIBC team said part of the muted enthusiasm is that the Big Six do not always move their lending rates in perfect tandem with the central bank, as evidenced in 2015, when lenders made more incremental changes to their rates in the face of the pair of Bank of Canada cuts.

- 'Major quibble' as the Bank of Canada gears up to raise rates

- Boosting rates can curb the 'debt appetite' of Canadians: CIBC

- 'Misguided' for Bank of Canada to raise rates: Capital Economics

BANK OF CANADA: WILL THEY OR WON'T THEY?

“We are very interested to see how prime behaves for the first couple of moves. Recall that the last two decreases in the overnight rate were met with only a partial decline in the bank prime rate,” the analysts wrote. “Accordingly, there is the potential that politically astute banks will make only a partial move in prime, though it is hard to have any conviction on this call.”

The CIBC analysts said if anything, the biggest bright spot for the sector as the Bank of Canada tightens policy is that it reflects a rosier outlook for the broader economy, which would be the main boost to their books.

“We can now move the outlook for the margin from the possible headwind category to the possible tailwind category… hardly a game changer, but incremental positives in what was already a pretty good operating environment for most of the business definitely beats the alternative,” the analysts wrote.

“The fact that the outlook for the economy makes this a serious discussion point again is enough to sustain our optimistic outlook on the banks at this time.”