Mar 14, 2023

First Republic, PacWest Lead US Bank Rebound From Post-SVB Rout

, Bloomberg News

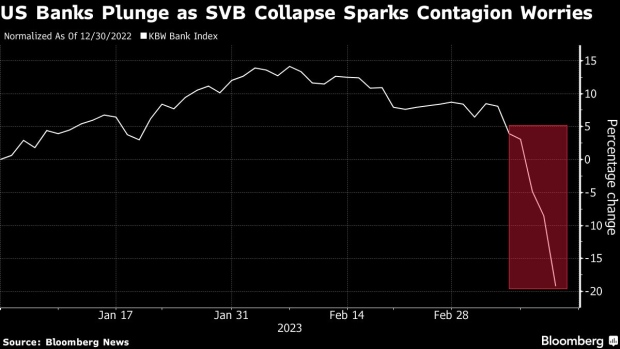

(Bloomberg) -- Regional US bank stocks led by First Republic Bank and PacWest Bancorp clawed back some of their steep losses in the wake of Silicon Valley Bank’s collapse.

First Republic closed 27% higher in New York, its biggest single-day gain ever, while PacWest gained a record 34% and Western Alliance Bancorp rose 14%. Meanwhile, Charles Schwab Corp. climbed 9.2% after its CEO said he bought shares. The KBW Bank Index, one of the main gauges for the financial industry, gained 3.2%.

Still, the banks closed well below their early-session highs — First Republic was up 63% and PacWest 77% at one point — amid ongoing concern that there may be more trouble ahead for the sector. Moody’s Investors Service cut its outlook for the US banking system to negative from stable, citing the run on deposits that led three banks to collapse in less than a week, after earlier placing six banks on review for downgrade. S&P Global Ratings placed First Republic on credit watch negative.

“Regional bank shares are climbing higher as if there’s an ‘all clear’ signal,” LPL Financial Chief Global Strategist Quincy Krosby said. “Questions remain whether there are risks still embedded on balance sheets, particularly if depositors continue to demand funds.”

While Tuesday morning’s bounce helped stocks stem the recent carnage, shares were still far below levels from last week. First Republic would need a 268% rally from Monday’s close to reach its closing level from Wednesday, and PacWest would need to jump 174%.

“Once we move away from initial shock rather than painting everyone with the same brush, there is a tendency to scrutinize the models a bit more, the banks’ deposit bases and access to liquidity,” said Gary Schlossberg, global strategist at Wells Fargo Investment Institute. “There has been no foot-dragging by the government, we could even see more steps down the road to stabilize the system.”

Regulators stepped in with extraordinary measures, introducing a backstop for banks to protect the whole nation’s deposits, after the swift demise of three banks. Regional banks suffered the most on fears of a customer exodus to bigger lenders, perceived as safer for deposits.

Investor Michael Burry, who rightly predicted the 2008 housing crash, said he believes the spreading crisis following the collapse of Silicon Valley Bank could resolve “very quickly” and that he doesn’t see any “true danger.”

--With assistance from Alexandra Muller and Jan-Patrick Barnert.

(Updates shares, adds credit rating firms in fourth paragraph)

©2023 Bloomberg L.P.