Mar 22, 2023

First Republic Shares Inch Higher as Eyes Turn to Rescue Talks

, Bloomberg News

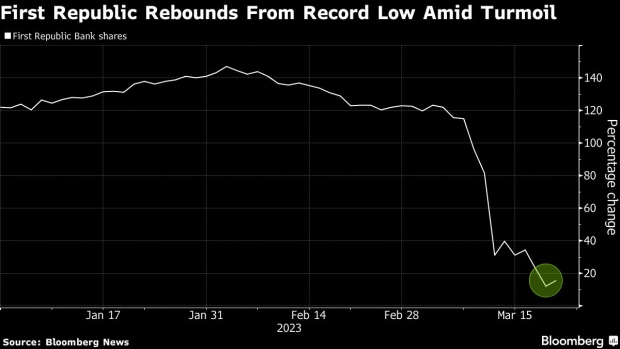

(Bloomberg) -- First Republic Bank shares slipped in early trading as all eyes remained on how talks aimed at shoring up the midsize lender were progressing after the stock’s record rout.

The California lender’s shares fell 2.7% as of 9:15 a.m. in US premarket trading, giving up gains from earlier in the session. Wall Street leaders and US officials discussing an intervention at First Republic are exploring the possibility of government backing to encourage a deal, Bloomberg reported, citing people with knowledge of the matter.

The bank, which caters to affluent clients via its wealth-management business, has seen its shares collapse over the past fortnight as the failure of three lenders, including Silicon Valley Bank, in quick succession shook confidence in regional lenders.

First Republic rose by a record on Tuesday, rebounding from Monday’s lowest-ever close. While the KBW Bank Index has risen nearly 6% so far this week, the gauge of 22 banking stocks remains down 24% this month.

In a bid to shore up confidence, a group of 11 Wall Street banks agreed to contribute $30 billion of deposits for the beleaguered lender last week.

Regional banking peer PacWest Bancorp’s shares sank as much as 16% in premarket trading, after the firm said it secured $1.4 billion from a financing facility from Atlas SP Partners after the bank saw deposit outflows of about 20% since the start of the year.

The banking sector was in focus ahead of a key interest rate decision from the Federal Reserve due later in the day, with the central bank caught between a choice of hiking, or pausing, amid turmoil in the financial industry. US officials are also looking at ways to insure all bank deposits if needed, Bloomberg reported on Tuesday.

(Updates to add latest trading starting in second paragraph and additional commentary.)

©2023 Bloomberg L.P.