Dec 12, 2022

Flood of Russian Crude Heads to Asia After EU Ban Kicks In

, Bloomberg News

(Bloomberg) -- Russia has all but ceased to be a supplier of crude oil to Europe.

A European Union ban on imports of Russian crude by sea came into force on Dec. 5, effectively closing off its closest oil market, which took roughly half the country’s supplies at the start of the year. With the exception of a small volume delivered to Bulgaria, seaborne flows of Russian crude to the bloc have halted.

The crude shunned by Europe has been diverted to Asia, with a flotilla of tankers steaming around the continent and through the Suez Canal to deliver cargoes to India and China. That flow swelled to more than 3 million barrels a day in the week to Dec. 9, accounting for 89% of all the crude shipped from Russian ports during the week, according to vessel-tracking data monitored by Bloomberg.

More than half of the crude loaded from ports in the Baltic, the Black Sea and the Arctic is heading for the Suez Canal on ships that are showing no final destination. It’s unclear whether all of this oil has been sold, or whether cargoes are heading to the region in the hope that they will be sold before they arrive.

Moscow has yet to retaliate against the ban and the linked $60 a barrel price cap on sales carried on European ships or seeking insurance and other services through its companies. Its threat to refuse sales to countries imposing the cap is hollow, as those nations have already banned imports of Russian crude.

A suspension of pipeline deliveries, another option that the Kremlin is considering, would hurt countries like Slovakia, Hungary and the Czech Republic, but would play into the hands of its other pipeline customers in Europe — Germany and Poland — which are already seeking ways to halt imports by the end of the year.

The volume of crude on vessels heading to China, India and Turkey, the three countries that have emerged as the biggest buyers of displaced Russian supplies, plus the quantities on ships that are yet to show a final destination, jumped in the four weeks to Dec. 9 to average 2.73 million barrels a day. That’s more than four times as high as the volume shipped in the four weeks immediately prior to Russia’s invasion of Ukraine in late February.

Tankers hauling Russian crude are becoming more cagey about their final destinations. The volume of crude on vessels leaving the Baltic and showing their next destination as Port Said or the Suez Canal jumped to 890,000 barrels a day. It remains likely that many of these vessels will begin to signal Indian ports once they pass through the canal, while shipments to the United Arab Emirates are becoming more common.

In the first week after the EU ban came into effect, total volumes shipped from Russia jumped by 468,000 barrels a day to 3.45 million in the seven days to Dec. 9, while the less volatile four-week average also rose.

Crude Flows by Destination:

On a four-week average basis, overall seaborne exports rebounded from the previous week’s drop, rising by 142,000 barrels a day to 3 million barrels a day. Shipments to Europe hit a low for the year, while those to Asia reached a new high.

All figures exclude cargoes identified as Kazakhstan’s KEBCO grade. These are shipments made by KazTransoil JSC that transit Russia for export through Ust-Luga and Novorossiysk.

The Kazakh barrels are blended with crude of Russian origin to create a uniform export grade. Since the invasion of Ukraine by Russia, Kazakhstan has rebranded its cargoes to distinguish them from those shipped by Russian companies. Transit crude is specifically exempted from the EU sanctions.

-

Europe

Russia’s seaborne crude exports to European countries fell to 215,000 barrels a day in the 28 days to Dec. 9, with Bulgaria the only European destination for Russian crude in the final three weeks of the period. These figures do not include shipments to Turkey.

The volume shipped from Russia to northern European countries fell to 48,000 barrels a day on average in the four weeks to Dec. 9, with no shipments to the region in the last three of those weeks.

Exports to Mediterranean countries slipped to 162,000 barrels a day on average in the four weeks to Dec. 9, hitting their lowest level for the year so far. Flows to the region, including Turkey, which is excluded from the European figures at the top of this section, fell for a fifth week.

Turkey was the only destination for Russian seaborne crude into the Mediterranean, but flows there also fell, dropping to their lowest since July on a four-week average basis. Shipments to the country in the four weeks to Dec. 9 were half the levels seen at the start of November; however, they remain more than twice the volume typically seen before the invasion. The country is expected to continue to be an important destination for Russian crude going forward.

Shipments to Italy slumped to zero. The country’s largest refinery, the ISAB plant in Sicily owned by Lukoil PJSC, has been struggling to secure credit to buy crude. It has been processing Lukoil’s own crude, much of it shipped from the Arctic, but that flow will now have to stop, with EU sanctions on seaborne imports of Russian crude coming into effect.

The plant could come under temporary Italian government administration to guarantee continuity of operations, but it won’t be nationalized, according to Industry Minister Adolfo Urso. Lukoil said that its Litasco SA unit is prepared to guarantee operations at the ISAB refinery using crude stored for the coming months and future deliveries of non-Russian supplies.

Flows to Bulgaria, now Russia’s only Black Sea market for crude, rose to a seven-week high of 167,000 barrels a day. Bulgaria secured a partial exemption from the EU ban on seaborne crude imports from Russia, which should support inflows now that the embargo comes into force. However, it remains unclear how Russia will retaliate on sales to countries that participate in the US-led price cap mechanism, which could affect shipments to the country.

-

Asia

Shipments to Russia’s Asian customers, plus those on vessels showing no final destination, which typically end up in either India or China, jumped to more than 2.5 million barrels a day. While the volumes on vessels signaling Indian or Chinese ports as their destination were little changed from the previous week, the number of ships showing destinations as either Port Said or Suez soared to the equivalent of almost 800,000 barrels a day on a four-week moving average basis. Those voyages typically end at ports in India and show up in the chart below as “Unknown Asia,” as do the volumes expected to be transferred from one ship to another off the South Korean port of Yeosu.

The “Unknown” volumes are those on tankers showing a destination of Gibraltar, Malta or no destination at all. Most of those cargoes go on to transit the Suez Canal, but some could end up in the Mediterranean region.

Cargoes heading for Asia that were bought at a price above $60 a barrel at the point of loading will have to be delivered before Jan. 19, if they are to retain their International Club insurance. Alternative insurance arrangements will need to be made for any cargoes that are discharged after that date.

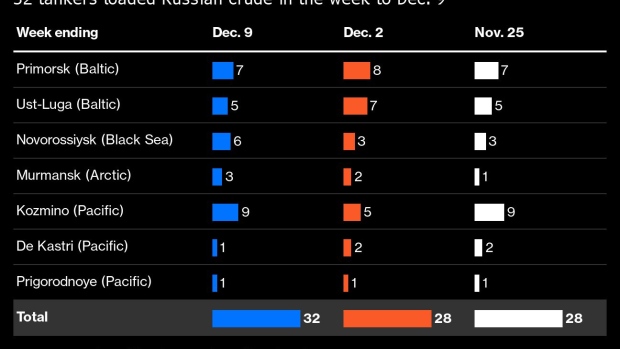

Flows by Export Location

Aggregate flows of Russian crude rose by 468,000 barrels a day, or 16%, in the seven days to Dec. 9, exceeding 3 million barrels a day for the first time in five weeks. Shipments from ports in the Baltic fell, while flows rose from the Black Sea, the Arctic and the Pacific port of Kozmino. Figures exclude volumes from Ust-Luga and Novorossiysk identified as Kazakhstan’s KEBCO grade.

Export Revenue

Inflows to the Kremlin's war chest from its crude-export duty rose by $21 million to $143 million in the seven days to Dec. 9, while the four-week average income rose by $6 million to $123 million, increasing for the first time in five weeks.

The December duty rate is $5.91 a barrel, according to figures released by the Russian Ministry of Finance. This month’s figure is based on an average Urals price of $71.1 a barrel, according to figures from the Russian Ministry of Finance. The duty rate for January could be much lower, with Urals prices in the Baltic averaging about $53 a barrel during the first 24 days of the January calculation period, which runs from Nov. 15 to Dec. 14, according to data from Argus Media.

Origin-to-Location Flows

The following charts show the number of ships leaving each export terminal and the destinations of crude cargoes from the four export regions.

A total of 32 tankers loaded 24.2 million barrels of Russian crude in the week to Dec. 9, vessel-tracking data and port agent reports show. That’s up by 3.26 million barrels, or 16%, from the previous week. Destinations are based on where vessels signal they are heading at the time of writing, and some will almost certainly change as voyages progress. All figures exclude cargoes identified as Kazakhstan’s KEBCO grade.

The total volume on ships loading Russian crude from Baltic terminals fell by one-fifth, reversing the previous week’s gain.

One tanker, the Alma, which loaded in the week to Dec. 2 and initially showed its destination as Rotterdam, sailed beyond the port and is now heading into the Mediterranean. No tankers loading in the week to Dec. 9 are showing destinations in Europe.

Shipments from Novorossiysk in the Black Sea jumped to a 14-week high. All of the ships showing a destination remained within the Black Sea, but two tankers are yet to signal a discharge point and could yet leave the area.

Arctic shipments rose to a five-week high in the seven days to Dec. 9 with three vessels leaving from Murmansk during the week. Two are heading to Asia via the Suez Canal, while the third is yet to signal a destination.

Shipments from the Pacific rebounded from a 12-week low in the seven days to Dec. 9. All of the cargoes heading for unknown destinations are on ships going to Yeosu in South Korea, where it’s likely that they will conduct ship-to-ship transfers outside the port, as previous tankers have done. All cargoes of Sokol crude loaded since shipments restarted in October have been moved in this way, with most eventually heading to India.

Note: This story forms part of a regular weekly series tracking shipments of crude from Russian export terminals and the export duty revenues earned from them by the Russian government. The next version of this story will be published on Tuesday Dec. 20

Note: All figures exclude cargoes owned by Kazakhstan’s KazTransOil JSC, which transit Russia and are shipped from Novorossiysk and Ust-Luga as KEBCO grade crude.

Note: Data on crude flows can also be found at {DSET CRUDE }. The numbers, which are generated by a bot, may differ from those in this story.

Note: Aggregate weekly seaborne flows from Russian ports in the Baltic, Black Sea, Arctic and Pacific can be found on the Bloomberg terminal by typing {ALLX CUR1 }.

©2022 Bloomberg L.P.