Mar 31, 2023

Flying Tiger Looks to Ikea as CEO Will Open 1,000 Stores in Asian Push

, Bloomberg News

(Bloomberg) -- Flying Tiger Copenhagen, the variety retailer that sells everything from water guns to yoga mats, plans to push into Asia to more than double its number of stores globally.

Chief Executive Officer Martin Jermiin said the Danish chain has already signed contracts covering about half of the new 1,000 outlets it will open over the next five years. Flying Tiger now has 900 stores, most of them in Europe.

“We completed a thorough analysis and will focus on growth markets where we can find top partners, and we see great potential in South East Asia,” the CEO said in a phone interview. “Now that Covid is no longer such a dominating factor we’re ready to speed up and so are our partners.”

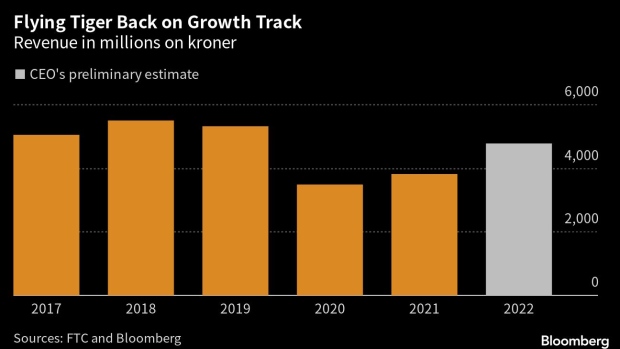

Flying Tiger has been burnt by expansions in the past. A 2018-2019 debt-fueled growth spree led to about $110 million in losses as costs mounted faster than sales from new stores. The retailer was forced to close unprofitable outlets and exit some countries, including the US.

This time it will be different, because the company is leaner after the consolidation, Jermiin said. And Flying Tiger, which is now owned by the Treville fund, won’t need any outside money to finance the push. Instead, it will use a franchise model, with partners covering much of the capital, he said.

“The risk profile for this expansion is much different,” said Jermiin, who’s previously worked as a partner at McKinsey and an analyst at Goldman Sachs.

The company will open an Asian headquarter in Singapore and outlets in Indonesia and the Philippines, as well as other countries. The plans don’t cover China, which is “a very complex and differentiated” market, the CEO said. “But it’s on a list of other countries we’re interesting in.”

Flying Tiger started as a stall at a Danish flea market. Now, it designs and markets its own products, and surveys show that its customers see fellow Scandinavian retailer Ikea as its main competitor, Jermiin said. However, Flying Tiger doesn’t sell large pieces of furniture and has no plans to do so.

“Ikea is obviously much bigger than us, but a fine yard stick for us to measure ourselves up again on how we can develop our brand,” the CEO said.

©2023 Bloomberg L.P.