Apr 25, 2022

Food Supply Fears Send Record Cash Flowing to Long-Forgotten ETF

, Bloomberg News

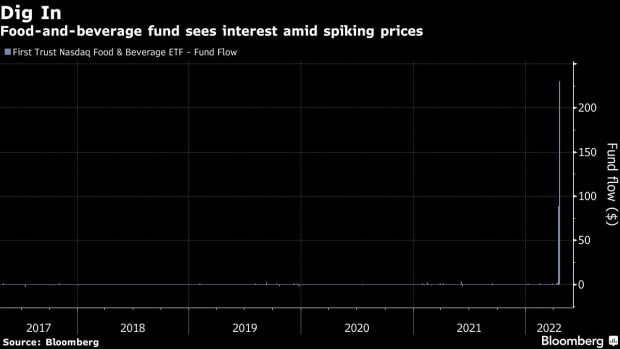

(Bloomberg) -- An exchange-traded fund focused on food and beverages is seeing a spike in interest for the first time since its creation amid fears over a mounting global food crisis and rising prices.

The First Trust Nasdaq Food & Beverage ETF (ticker FTXG) on Friday saw an inflow of $230 million, the most since its inception in 2016, data compiled by Bloomberg show. Investors have now added money into the fund for three straight days, following years of inactivity.

The inflow comes as prices for everything from wheat to cooking oils soar amid Russia’s invasion of Ukraine. The two countries are important agricultural exporters, with Ukraine ranking as the world’s largest producer of sunflower oil and a top-six exporter of wheat, corn, chicken and honey.

FTXG “is an interesting beneficiary of the war in Ukraine and food-inflation narrative,” Kevin Kelly, chief executive officer at Kelly ETFs, said by email. Some of its top holdings have seen “great performance in returns” amid ructions in the global food supply-chain.

Food prices were already climbing before the invasion of Ukraine, but the war and the subsequent sanctions put on Russia have led to global food prices surging at the fastest pace on record, adding to inflationary woes for consumers and worsening the worldwide food crisis. A United Nations index of food prices has soared every month this year, and has hit a record high in data going back three decades.

FTXG is up roughly 7% so far this year, while the S&P 500 has dropped more than 10%. The fund’s top holdings, including Archer-Daniels-Midland Co., Tyson Foods Inc. and Hershey Co., have all advanced since the end of 2021. The fund’s inflow “surely meets the definition of parabolic,” said James Pillow, managing director at Moors & Cabot Inc.

Pillow speculated the flows could be linked to a tweak to one of First Trust’s model portfolios -- off-the-shelf investment strategies often built using ETFs. Mohit Bajaj at WallachBeth Capital noted that cash has been moving in and out of other First Trust ETFs such as First Trust Consumer Discretionary AlphaDEX Fund (FXD), which has lost $420 million so far in April.

A spokesperson for First Trust did not immediately respond to a request for comment.

Other ETFs centered on food and agricultural products are also seeing new money coming in. Investors added a record $105 million into the iShares MSCI Global Agriculture Producers ETF (VEGI) last month, and another $93 million so far in April. More than $98 million has gone into the Invesco Dynamic Food & Beverage ETF (PBJ) since the end of March, the most since 2014. And the Invesco DB Agriculture Fund (DBA) has seen a roughly $830 million infusion over March and April thus far.

“This heated chase may prove correct for once, as making up for the agriculture deficit looks to be all-but impossible, as Russia continues its war against Ukraine,” Pillow said.

©2022 Bloomberg L.P.