Jun 1, 2022

Ford’s CEO sees EVs helping carmaker pare its US$3B ad budget

, Bloomberg News

Ford delivers first F-150 EV truck

Ford Motor Co. Chief Executive Officer Jim Farley doesn’t see a need for traditional advertising for his company’s electric vehicles -- if they’re good enough to sell themselves.

“We spend US$500 to US$600 per vehicle on public advertising. Get rid of all of it,” Farley said Wednesday at the Bernstein Strategic Decisions Conference. “If you ever see Ford Motor Co. doing a Super Bowl ad on our electric vehicles, sell the stock.”

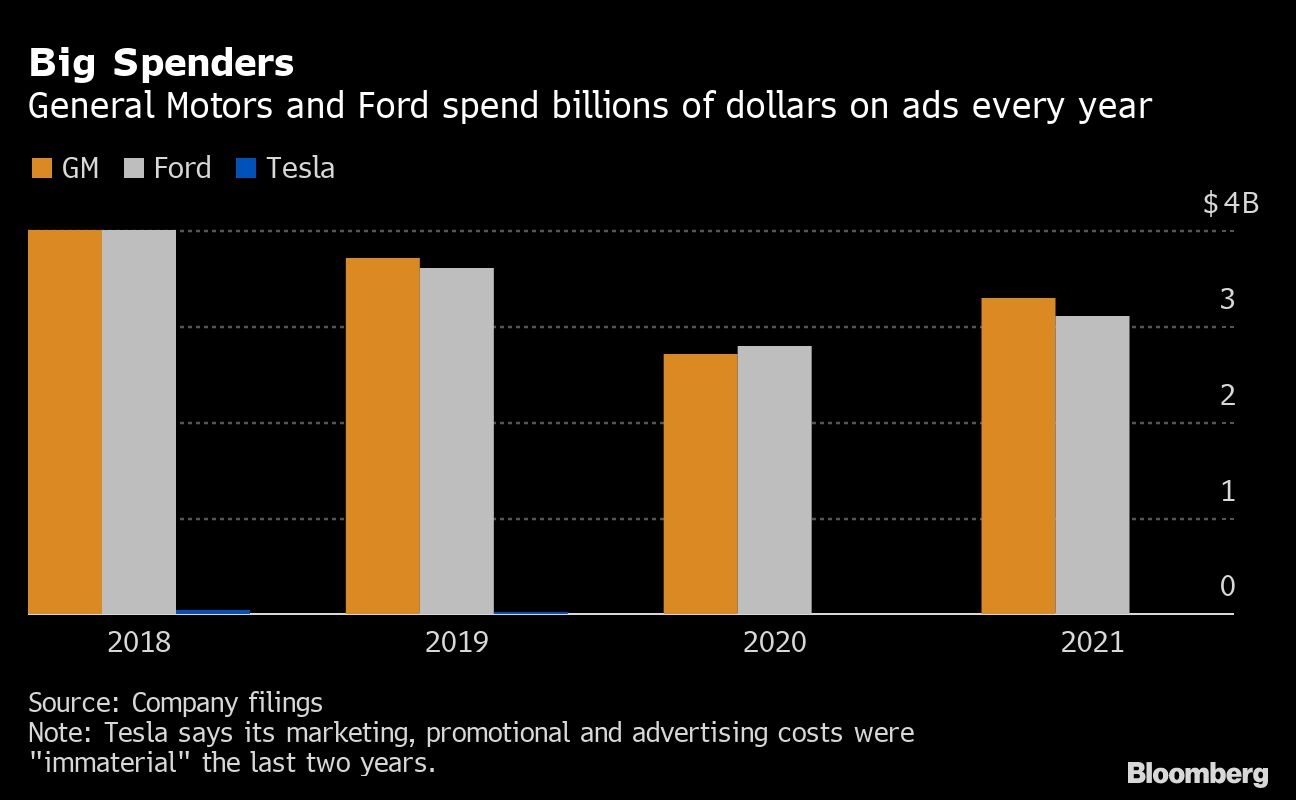

Ford is one of the nation’s biggest advertisers, spending US$3.1 billion last year promoting its products. But Farley wants to emulate Tesla Inc., which controls the US market for EVs despite not buying traditional advertising. He said Ford hasn’t needed to advertise its new F-150 Lighting plug-in pickup and that it stopped promoting its electric Mustang-Mach E because “it’s sold out for two years.”

“I’m not convinced we need public advertising for” electric vehicles “if we do our job,” Farley said.

Farley, who is spending US$50 billion on EVs through 2026, said his company’s advertising budget would be better spent to improve the customer experience for Ford’s car buyers, giving them special service and treatment at dealers throughout the life of their vehicle.

“Our model’s messed up,” Farley said. “We spend nothing post-warranty on the customer experience.”

Farley said Tesla has a cost advantage of US$2,000 a car because the electric automaker has a direct sales model that doesn’t include car dealers.

But Farley isn’t looking to do away with dealers, who he contends could be a competitive advantage. He sees their role changing to focus on service after the sale. He also believes dealers will have to do 100 per cent of sales online, with no-haggle pricing.

“Our dealers can do it, but the standards will be brutal,” Farley said. “Their business will change a lot and there will be a lot of winners and losers and, I believe, consolidation.”