Dec 9, 2021

Foreigners Boost China Sovereign Debt Holdings Amid Yuan Gains

, Bloomberg News

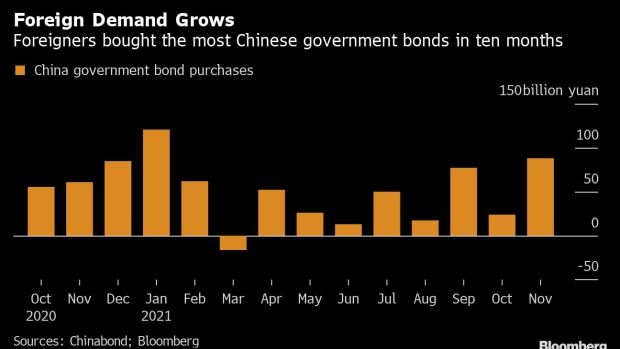

(Bloomberg) -- Foreign investors boosted their Chinese government bond holdings last month by the most since January as the yuan’s gains raised the attractiveness if the nation’s debt.

Overseas investors bought 87.9 billion yuan ($13.8 billion) of the bonds last month, more than three times their October purchases, according to data from ChinaBond. Their overall holdings surged to a record-high of 2.39 trillion yuan.

“The yuan’s resilience and low volatility raised the appeal of Chinese onshore bonds,” said Zhaopeng Xing, a senior China strategist at Australia & New Zealand Banking Group Ltd. Inflows related to the central bank’s reserve diversification remain strong, he added.

The onshore yuan gained 0.6% in November and it’s poised to become Asia’s best-performing currency this year with 2.9% gains on the back of a strong trade surplus and robust inflows. A strong currency along with the People’s Bank of China’s accommodative stance have boosted the nation’s sovereign bonds, especially as other major central banks move toward tightening policies.

The share of China’s sovereign bonds held by overseas investors rose to 10.9% in November from 10.7% last month, according to Bloomberg calculation. That’s after the bonds were included in FTSE Russell’s flagship index in October, which analysts expect to drive around $130 billion of inflows across three years.

The ChinaBond data cover the majority of the interbank market, where most government and policy bank notes are traded. More figures will likely be released by the Shanghai Clearing House that will include some credit bonds in the interbank and exchange markets.

©2021 Bloomberg L.P.