New US Home Sales Jump to Highest Level Since September

Sales of new homes in the US bounced back broadly in March as an abundance of inventory helped drive prices lower.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Sales of new homes in the US bounced back broadly in March as an abundance of inventory helped drive prices lower.

Hong Kong developer Lai Sun Development Co. is considering options for a planned office tower in the City of London, including a potential sale of a stake in the project.

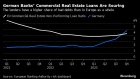

Germany’s financial regulator BaFin is taking a closer look at the real estate used by lenders to secure covered bonds known as Pfandbriefe, a €400 billion market traditionally considered among the safest in credit.

Taylor Wimpey Plc is failing to see lower mortgage rates translate into higher levels of home sales and is maintaining its forecast for fewer deals in 2024.

Chinese mainland investors increased their portion of total turnover of Hong Kong stocks to a record daily average in April, with the latest measures to bolster the city’s position potentially boosting their purchases.

Oct 26, 2021

Parker Lane wasn’t sure why he had to make an offer on a suburban Ontario home before he could ever get it inspected.

The 43-year-old was looking to move into a bigger place for his family of four in Hamilton this fall, when the housing market threw him in for a loop.

“I’d already purchased a great place in the area that we lived in for years and another before that,” Lane said in an interview. “But this was something I hadn’t seen before.

“They literally wanted us to forgo something as basic as a house inspection because they already had too many other offers — many of which, apparently, were coming without people needing to do an inspection before wanting to buy the house.”

Eventually, Lane decided to look elsewhere. “It wasn’t so much about making the offer itself… I just didn’t like the idea of spending so much on a home I’d be living in with my young kids without having that peace of mind,” he said.

Lane isn’t the only Canadian homebuyer this has happened to in recent months.

Several provinces away, Anna-Leigh Murphy was planning to purchase her first house with partner Shelley Springer in Langley, British Columbia.

“We weren’t really sure what we were getting into when we started looking this summer,” Murphy said. “But it wasn’t like once or twice that this happened, we just kept getting told this is something that’s common now. That everyone is opting out of home inspections these days because of all those bidding wars.”

According to the latest numbers from the Canadian Mortgage Housing Corporation (CMHC), the country’s housing market has moved from moderate to a high degree of vulnerability before the winter months — prompted by price accelerations and consistent overvaluation imbalances.

That means there is potential for a downward market correction in the near future, the CMHC suggests. So, the number of sellers and buyers will be on pace with one another, unlike the home inventory shortages coupled with heated demand seen during the pandemic.

Alan Carson, chief executive officer of Canada’s leading home inspection agency Carson Dunlop who has been in the sector for nearly 40 years, said “during hyper-competitive landscapes like today’s market, forgoing home inspections has become a common and worrisome trend.”

He said it’s “obvious” why it’s a worrying trend for homebuyers, because they risk going into a blind offer for a major investment without knowing future causes of concern — from moulding, plumbing and heating issues to major problems like infestations and roof or water damage.

“How can you invest in something that’s probably one of your biggest-ever purchases without knowing what you’re signing up for down the road?” Carson said.

But he added, “what perhaps isn’t understood as much,” are the considerations that home-sellers should also have about the ostensibly worrying trend.

“The CMHC figures show that home-sellers are getting used to something that might not last in the future: blind offers without inspections,” Carson said.

“When those predicted downward market corrections do happen, and if the interest rates increase, a proper regime and protocols for home inspections will be the answer to make sure we’re still functioning on a proper trajectory for the housing market.”

Still, Carson insists, the trend of forgoing home inspections is something that ultimately should be mandated against from a regulation and government perspective, without the onus falling on sellers or buyers.

“It definitely needs to change. Because right now, it’s perfectly allowed to purchase and move into a place without ever knowing the exact condition,” he said.

“And that sort of thing not only causes blind bidding, it actually might be encouraging it.”