Sep 8, 2020

Forint Rises as Hungary Moves to Curb Quarter-End Rate Gyrations

, Bloomberg News

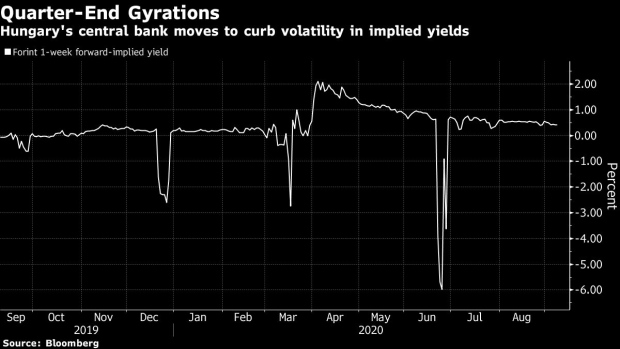

(Bloomberg) -- The forint recovered from its weakest level in five months after Hungary’s central bank announced measures to reduce distortions in the money market.

The currency pared a decline of as much as 0.5% against the euro to trade 0.2% stronger at 358.83 per euro after the monetary authority said it would start offering foreign-currency liquidity to lenders.

The new facility, which may draw funds from a swap line established with the European Central Bank in July, will provide banks with foreign-currency liquidity and help avoid quarter-end distortions that pushed short term borrowing costs below zero in June.

“The National Bank of Hungary aims to ensure that in these special periods, short-term money market yields adjust to the level of short-term rates deemed optimal,” it said in a statement on its website.

The measures will provide investors with clues on how the central bank is adapting its policy to a dual threat in economic indicators. Price growth is already at the top of rate setters’ tolerance band and the monetary authority is under pressure to steer the economy out of eastern Europe’s deepest recession in the second quarter.

The foreign-currency liquidity swap will complement a forint-providing facility the central bank has used since 2016 to steer interbank cash volumes and money-market rates.

“The main intention is to achieve a more orderly swap market after the disruptions seen in June, but the measure could also act as a strong-enough trigger to bring some stability for the forint, which has broken loose recently,” said Tunde Miszkuj, the head of money-market trading at Raiffeisen Bank in Budapest. “This may put a limit to further depreciation and prompt a small correction, but a lot will depend on when and to what extent they use the new facility.”

©2020 Bloomberg L.P.