Aug 5, 2022

Former SPACs Keep Missing Earnings Estimates as Shares Fizzle

, Bloomberg News

(Bloomberg) -- As the earnings season wraps up there’s a pocket of the market where results have been particularly lackluster -- companies that went public through a SPAC merger during the height of the blank-check craze.

Disappointing earnings this week from companies ranging from a mobile gaming platform that’s a former darling of Cathie Wood’s Ark Invest to an indoor farming firm with home decor guru Martha Stewart on its board hit the already battered group.

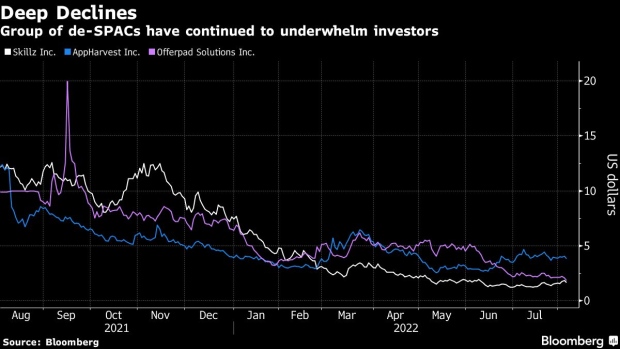

With more than two-thirds of the benchmark S&P 500 Index components reporting results so far, fewer are topping Wall Street expectations as the market battles a choppy economic outlook. Stocks from blank-check deals are faring worse. The De-SPAC Index, a basket of stocks from companies that have completed their tie-ups, has fallen 67% in the past year. More than 85 of the roughly 385 former SPACs trade below the $2 mark, data compiled by Bloomberg show.

“Earnings season has not been kind to de-SPACs as a global economic slowdown is raising the risk that many will be forced into liquidation,” said Ed Moya, senior market analyst at Oanda Corp. “A global recession is making it harder for these de-SPAC companies to provide a clear pathway to profitability.”

Special-purpose acquisition companies were heralded as a way to help companies get a public listing with fewer restrictions on financial projections compared with a traditional initial public offering. But many companies that merged through a SPAC have struggled to meet forecasts they made before combining, sending share prices plummeting and drawing attention from securities regulators.

Some companies that reported results this week were former SPACs with business models that have drawn skeptics. The worst performers were hit by losses of more than 10% after earnings, adding to declines that have wiped out as much as 91% of their value since going public.

Below are some highlights of post-SPAC companies that provided lackluster updates:

- Mobile gaming company Skillz Inc., which once counted Wood’s Ark Invest as its largest holder, slashed its full-year revenue expectations to $275 million from the $400 million it laid out earlier this year. Those expectations are half of what the company estimated it would deliver when it struck its SPAC deal in September 2020. It stock has spiraled 91% since its debut three months later.

- AppHarvest Inc., whose board of directors includes Martha Stewart, had worse-than-expected quarterly net sales and warned it will lose more money than initially forecast due to weaker sales expectations and higher cost of goods.

- Online home-flipper Offerpad Solutions Inc. hit a record intraday low of $1.75 after second-quarter revenue missed expectations. The company forecast third-quarter revenue between $600 million and $800 million, well below consensus estimates for $1.15 billion, Bloomberg data show.

- Virgin Galactic Holdings Inc. dropped after again delaying its commercial service, calling for a launch in the second quarter of 2023 and spurring cash concerns among analysts.

- Lucid Group Inc., viewed among the most successful former SPACs to emerge from the pandemic, spiraled on Thursday after the luxury electric-vehicle startup halved its 2022 production target.

- Holley Inc. -- a maker of high-performance aftermarket products for cars and trucks and battery maker Eos Energy Enterprises Inc. were among smaller de-SPACs to report quarterly updates that underwhelmed Wall Street over the past two weeks.

There have been some bright spots:

- SoFi Technologies Inc. surged after boosting its full-year view and Lordstown Motors Corp. rallied on better-than-expected results.

- Verra Mobility Corp., which provides technology to manage tolls, violations and registrations for vehicle fleet operators, reported second-quarter revenue that topped analyst expectations and grew by 46% from the prior year. Verra’s more than 60% rally since its 2018 SPAC merger has made it one of the top performers with gains outpacing the benchmark S&P 500 Index.

- Online gaming firm DraftKings Inc., which helped spark the SPAC mania, raised its full-year revenue view as the company continued to sign up new bettors despite decades-high US inflation squeezing consumers’ budgets.

©2022 Bloomberg L.P.