Feb 19, 2020

Fortress Said to Increase Offer to Purchase Mt. Gox Claims

, Bloomberg News

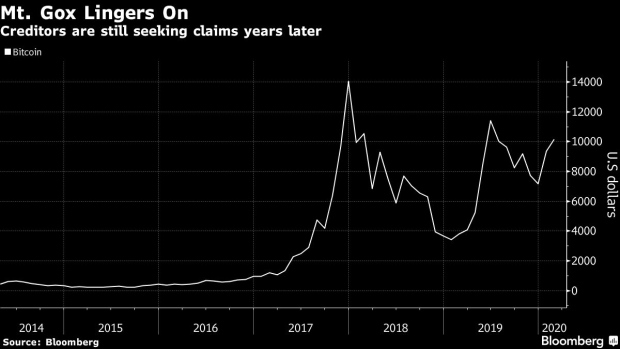

(Bloomberg) -- Fortress Investment Group LLC increased its offer to purchase creditor claims from the defunct Mt. Gox cryptocurrency exchange in the wake of this year’s Bitcoin rally.

The private-equity and hedge-fund firm sent letters this week to creditors offering $1,300 per Bitcoin, or 88% of its estimated account value, according to the one-page proposal, which Bloomberg News obtained from a person who said they weren’t authorized to speak on the matter. In December, the firm offered $755, and when Bitcoin traded lower, it dropped the price to as little as $600 per Bitcoin last March.

Based in Japan, Mt. Gox was once the world’s biggest Bitcoin exchange, until it closed in early 2014 after losing the coins of thousands of customers. Thousands of Bitcoins have since been found, and a trustee is working to reimburse creditors. The reimbursement is being delayed by lawsuits.

Michael Hourigan, a managing director at Fortress, said in the letter that firm is making the discount offer “due to the likely timeline (3 to 5 years) and financial risk of the ongoing litigations” involved in getting money from Mt. Gox.

Bitcoin has rallied about 40% since the beginning of the year to cross $10,000.

To contact the reporter on this story: Olga Kharif in Portland at okharif@bloomberg.net

To contact the editors responsible for this story: Jeremy Herron at jherron8@bloomberg.net, Dave Liedtka, Rita Nazareth

©2020 Bloomberg L.P.