Apr 22, 2022

Four SPAC Offerings Aborted as Investors Flee From Blank Checks

, Bloomberg News

(Bloomberg) -- Plans for four new blank-check firms have been pulled in less than 24 hours by the serial dealmakers at Navigation Capital Partners as the once frenetic industry goes cold.

Navigation won’t proceed with efforts to raise $150 million apiece for Navigation Capital Acquisition VI, VII, VIII and IX, regulatory filings show. The shelved special-purpose acquisition companies counted investors Lawrence Mock and David Panton as chairmen of two. Another was led by Chief Executive Officer Lonnie Johnson, inventor of the “Super Soaker” water gun, and one featured Super Bowl champion Jerome “the Bus” Bettis on its board.

The aborted quadruple play brings the week’s total of pulled SPAC filings to seven, the second-biggest weekly total this year behind a mid-March rout, when 11 were canceled. All told, at least 56 SPACs with ambitions to raise more than $16 billion have been called off this year.

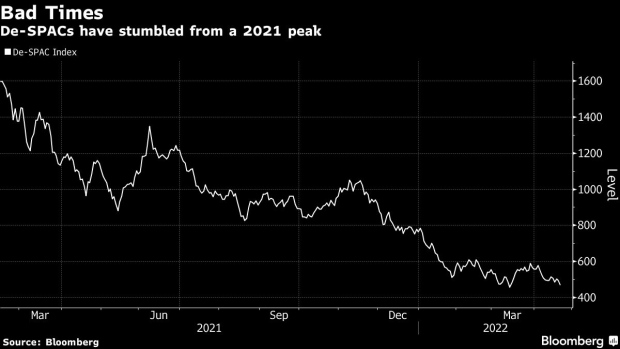

Investors have soured on SPACs as key gauges for the sector churn near record lows and U.S. regulators clamp down on the industry. The De-SPAC Index, which tracks 25 companies that have gone public through a merger with a SPAC, is on pace for a 6% drop this week, bringing losses from its February 2021 peak to about 70%.

SPACs are called blank checks because they raise cash from investors through a public offering with the goal of buying a private business. The industry has been stung by sketchy accounting and gut-wrenching stock drops. A backlog of more than 600 firms need to find deals ahead of deadlines that require them to complete a merger or liquidate, spooking investors on the outlook for the vehicles and companies they take public.

Bigger banks that handled previous SPAC offerings have abandoned the industry amid uncertainty regarding proposals from the U.S. Securities and Exchange Commission, and as shares of companies that complete their mergers fizzle. Just 58 SPACs have gone public this year, down from more than 850 in the two years prior.

©2022 Bloomberg L.P.